Fundraising Partners

Understanding Startup Funding: From Seed to IPO

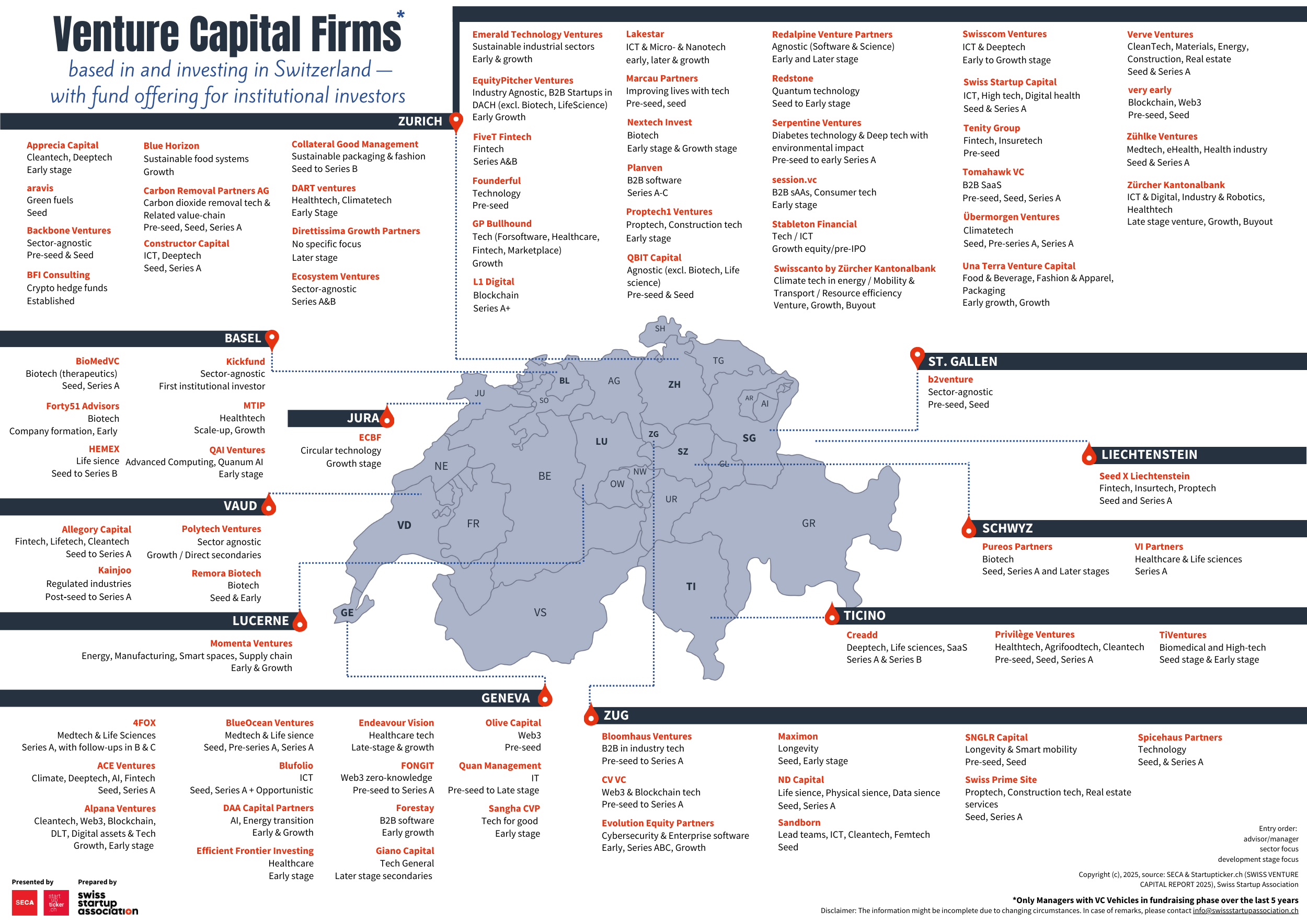

Navigating the startup funding landscape can be complex and overwhelming, especially for first-time founders. Each stage of funding comes with its own goals, expectations, and challenges. Understanding these early on can help you make smarter decisions and better prepare your startup for success.

Below is a structured breakdown of the primary funding stages, including what each stage aims to achieve, typical amounts raised, and the types of investors you might encounter along the way. Whether you’re just starting to build your product or preparing for an IPO, knowing where you stand and what’s ahead can significantly improve your fundraising strategy and outcomes.

Note: The funding amounts and stages are indicative and can vary based on the startup’s industry, market conditions, and investor interest.

What makes a startup too early or too late for you to invest?

<Too early for us is when there is no product yet and thus no market validation. Too late is when the round is already oversubscribed or the valuation assumes full product-market fit before it’s been achieved.>

Spicehaus Partners – Teddy Amberg

How much traction is "enough" to raise a pre-seed or seed round?

<It varies, but generally we look for consistent user growth, early signs of monetization, and a clear path to scale. More importantly, we want to see that the team can execute and iterate based on market feedback.>

DART Ventures – Arijana Walcott

How the valuation of an early-stage startup is evaluated?

<We benchmark against similar startups in our ecosystem and assess what the company needs

to achieve until the next round. The valuation should compensate the founding team for what they’ve built so far and leave enough upside for new investors, while not setting a too high or unrealistic benchmark for the next round.>

Spicehaus Partners – Teddy Amberg

Is it better to raise a bigger round or stay lean with a smaller one?

<It depends on the company’s capital efficiency and near-term goals. We like lean startups that prove traction with limited resources – with the ultimate goal of becoming a real, i.e. revenue-generating and profitable business. Having said that, a round should be large enough to reach the next major milestones that are needed to attract follow-on investors. >

Spicehaus Partners – Teddy Amberg