Everything You Need to Know About Pitch Decks

What is a pitch deck, when do you need it and why is it so important to have a good one?

In this article, we will provide you with the answers to these questions, as well as touch on things to consider when in the process of creating a pitch deck. Further, we will elaborate on the subjects of form and layout as well as which content you should include in your slides. To give examples we also included pitch decks from successful companies, which will give you a clearer impression of what your pitch deck should look like to engage investors.

The goal of your pitch is to raise interest in your startup, not to give investors every little detail. At the end of the day, all your pitch has to do is to tell a story – which is as fact-based as possible – to convince an investor to give you a second meeting.

With a pitch deck you are telling the story of your company. So make sure it is an exciting one!

Sometimes pitch decks are sent to potential investors instead of being presented. Keep in mind that you therefore may have to alter or include something extra (such as a product demo video) as you cannot present live.

*Please note that this guide does not provide specific advice on how to present and pitch your case.

In general, a pitch deck consists of the following slides (based on Guy Kawasaki’s pitch deck structure):

1. Title

2. Problem

3. Solution

4. Underlying Magic

5. Business Model

6. Go-To-Market Plan

7. Competitive Analysis

8. Management Team

9. Financial Projections + Key Metrics

10. Current Status, Accomplishments + Use of Funds

What to look out for in general

Investors are human beings with a limited attention span, just like everyone else. They are only capable of processing a certain amount of slides and information, and this point is usually reached after 10 slides. So try not to exceed this number.

Do you have great expertise in your field and know lots of jargon? Great! But investors do not particularly care about this. They are usually not as knowledgeable in the field you are an expert in. Therefore, try to keep your wording fairly easy and try to avoid complicated jargon.

Also, try to not only focus on just presenting your product or service. Rather, but focus also on exhibiting how you are helping your customers to solve their problems.

Form and Layout of Pitch Decks

Having a nice design is always a plus point. But in the case of your pitch deck, you should consider the form and layout of your slides as a hygiene factor. It is far more important to have engaging content and supportive metrics in your presentation than to have superb design.

Companies such as Uber and Airbnb used slides lacking particularly attractive designs back in the day, but look at where they are now.

The design of your pitch deck is not a factor that will make or break your case, the facts do. Just make sure to have a consistent design across all of your slides. You do not have to invent something entirely new.

In addition, it is important to not overload slides. Keep to one idea or topic per slide as a rule of thumb.

Also: No one likes tiny fonts. Investors are no exception. Try to use fonts no smaller than 30 point.

Content of Pitch Decks

When creating a pitch deck, you should aim to produce around 10 slides to present. Any significantly higher number and you will lose investors’ attention. The 10 following slides should be part of every pitch deck, as they cover the essentials. And that is what investors are anticipating. Do not include a lot of details.

The ‘Title’ Slide

This slide is the first impression investors get when you are pitching.

Make sure to include your company’s name as well as your own name and title, address, email and phone number. This way, investors can get in touch with you easily.

At this point, it might be a good idea to already give the investor a clue about what the company could be about. You can do this by using a tagline or a mission statement.

The ‘Problem/Opportunity’ Slide

With this slide, you should describe what problem you are fixing or which opportunity you are creating with your company. Maybe tell a relatable story involving the problem and exhibit how your product or service can tackle it. This way you can get investors to connect with your company and your vision.

This is a redesigned slide of Youtube’s Pitch Deck

The ‘Solution’ Slide

Explain how your product solves the aforementioned problem. Include the value of your ‘solution’ for the problem.

This is the redesigned ‘Solution’ slide of Youtube’s Pitch Deck

The ‘Underlying Magic’ Slide

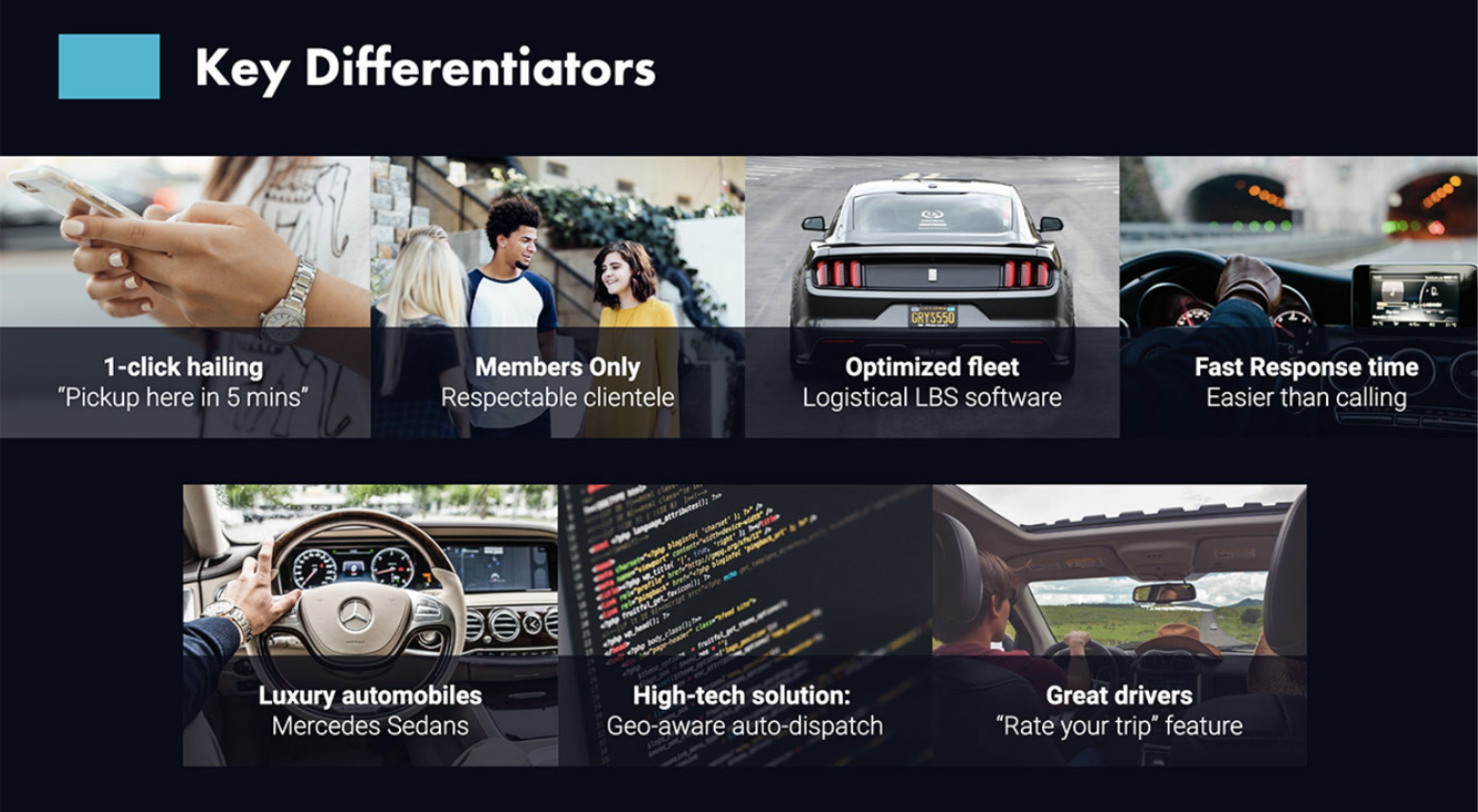

On this slide, the technology, secret sauce or magic that makes your company so special should be described.

This is where you include your demo or prototype. Try to use illustrations. Also, mention benefits instead of features. This way investors will engage with your idea more.

Uber highlights which features make their company unique.

The ‘Business Model’ Slide

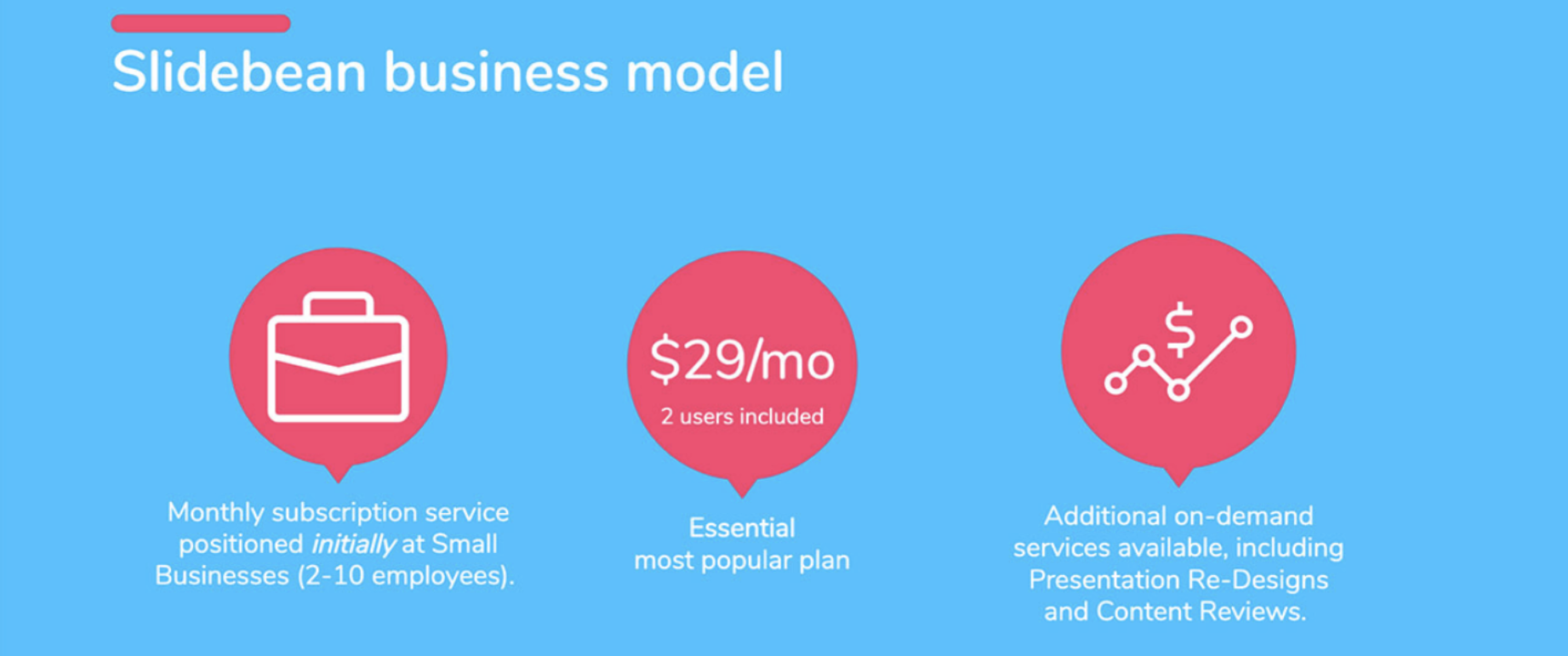

Describe how your company works and how it generates profit, or will in the future.

This is how Slidebean presented its business model.

The ‘Go-To-Market Plan’ Slide

It is fundamental to figure out how to distribute and market your product or services.

Just telling investors that you do “a bit” of social media marketing is not enough. In the end, every company is a marketing company. Even if you are literally doing rocket science and just selling your technology, you still have to find someone to buy your technology. So give a detailed account of how exactly you distribute and market your product. This way, investors will know you have thought things through and are ready for an investment.

What does your action plan look like? How are you going to acquire customers and keep them? Which partners are you leveraging? Why do you believe that those partners are willing to work with you and what is in it for them? Include answers to these questions on this slide.

Keep in mind that many companies have failed because they underestimated the efforts to market their products.

This is how Youtube presented its Sales & Distribution strategy.

The ‘Competitive Analysis’ Slide

Provide an overview of your competition, showing what they are lacking in comparison to you.

What is something that makes you unique and therefore will make your company more profitable than your competition? What is your edge? And how sustainable is that edge over your competitors?

This is how Buffer placed itself within the competitive landscape.

The ‘Management Team’ Slide

Present the key players of your management team. Investors will not invest if they doubt the capabilities of the management team. Investing is also very much a people-based decision. Highlight why you have the right team to make your company successful.

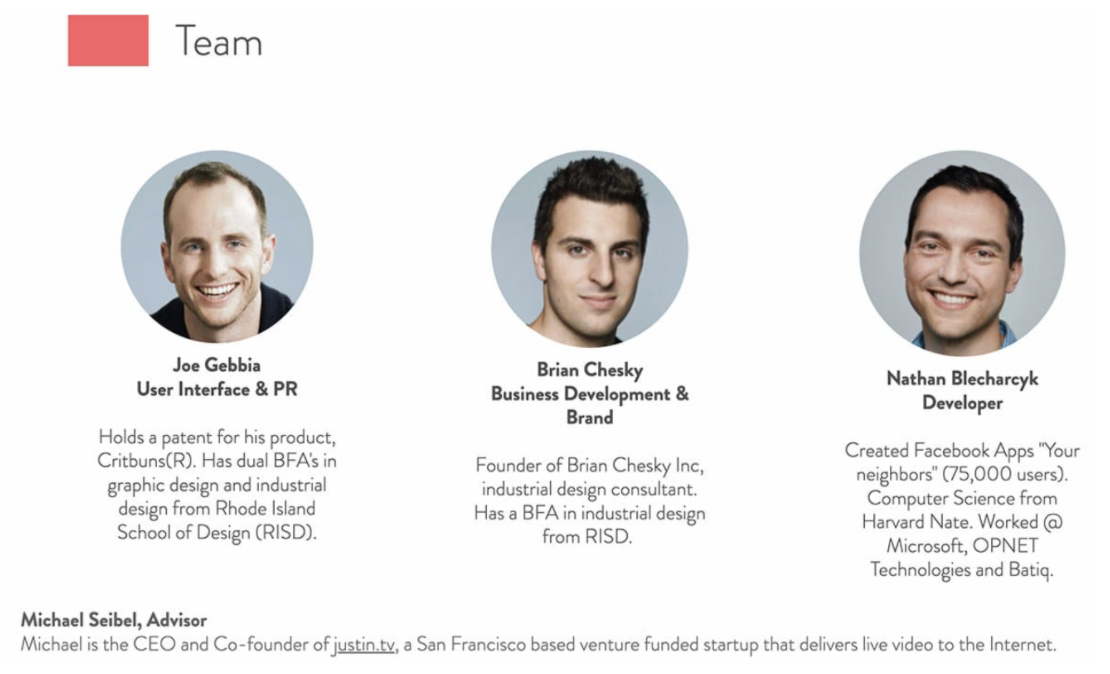

This is how Airbnb presented its core team.

The ‘Financial Projections and Key Metrics’ Slide

Enclose a three-year forecast including key metrics, such as the number of customers and conversion rate.

Use a bottom-up forecast, not a top-down one. Top-down models take the entire market as a starting point and work down, while bottom-up forecasts focus on the individual business and how it will expand. The bottom-up method offers a more realistic forecast of the financial future of the company – and that is what investors are looking for.

Many startups forget to show clear unit economics. How much does a customer cost to acquire (CAC), how much does the product or service cost to deliver (COGS), how much revenue do you make per transaction and ultimately what margin are you left with?

Be sure to answer these questions with this slide.

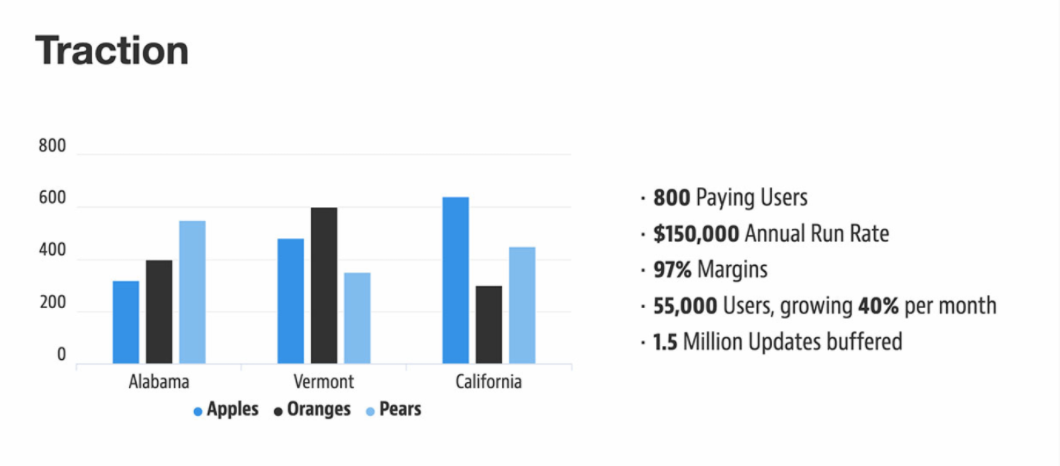

Investors are keen to see any traction you already have. (This is a redesigned slide of Buffer’s Pitch Deck.)

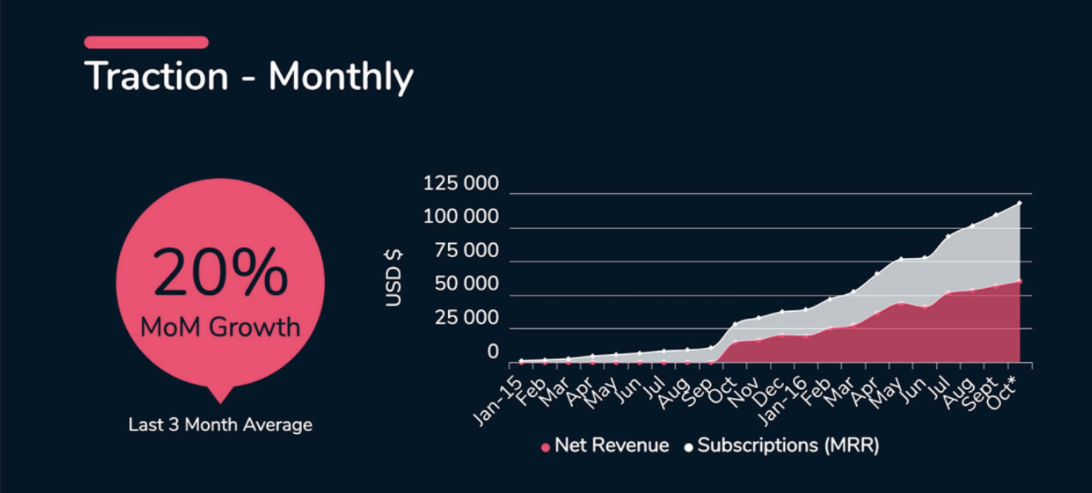

This slide from Slidebean’s pitch deck shows another option on how to present your traction.

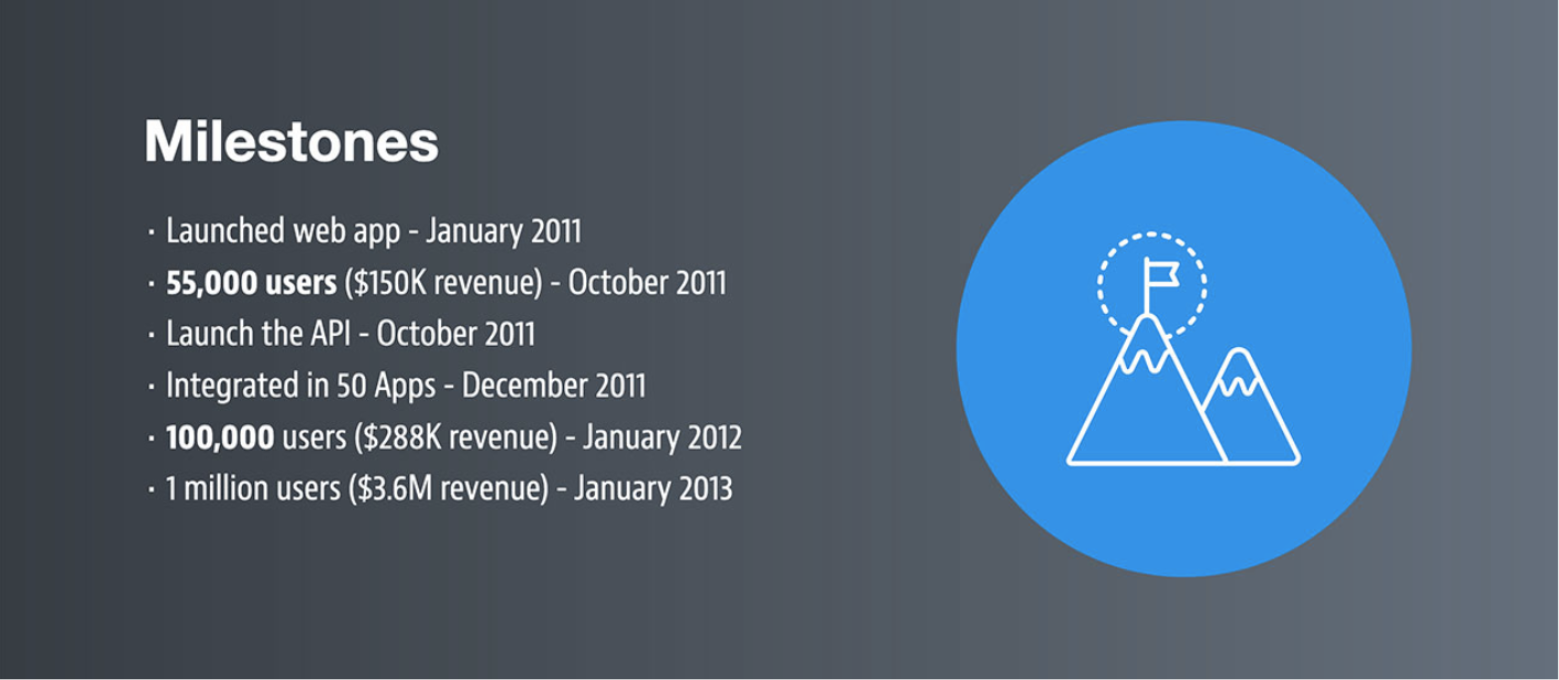

The ‘Current status, Accomplishments to date, Timeline, Use of funds’ slide

Give an account of the current status of your product and company. What milestones do you want to reach in the near future and what do you want to use the investment for? This is also where you tell the investors how much money you are asking for. Highlight why you need funding at this moment in your company’s development.

This is how Buffer shared the company’s milestones to date.

Final Comments and Benefit

Creating a pitch deck is always a big challenge as you have to reduce the written content to the max, while ensuring that the key messages come across. Do not overload slides and focus on key messages. Before you approach investors, share it with other founders and ask for feedback. Maybe you want to ask your network to describe what messages they read from each slide. This way you can test whether the message comes across as you desired.

You can easily waste a lot of time in tweaking and optimizing your pitch deck. If your fundamentals do not attract investors, then also the most beautiful pitch deck will not help.

Having a work in progress pitch deck may help you as a founder to stay on top of the big picture as you can detect, whether the story is on track or whether you got distracted along the way. From A-Z the story has to be plausible in its core.

Need some more inspiration? Check out what the pitch decks of AirBnB, BuzzFeed and Dropbox looked like, here (external source)!

Are you in the process of preparing your pitch deck? We got you! The SSA teamed up with BV4 to give you a free pitch deck assessment in form of a rating and a quick debriefing call!

Redeem this offer in the benefits section or register as a member if you haven’t already. Much success!

AUTHORS

Julian Stylianou