An intro to convertible Loans

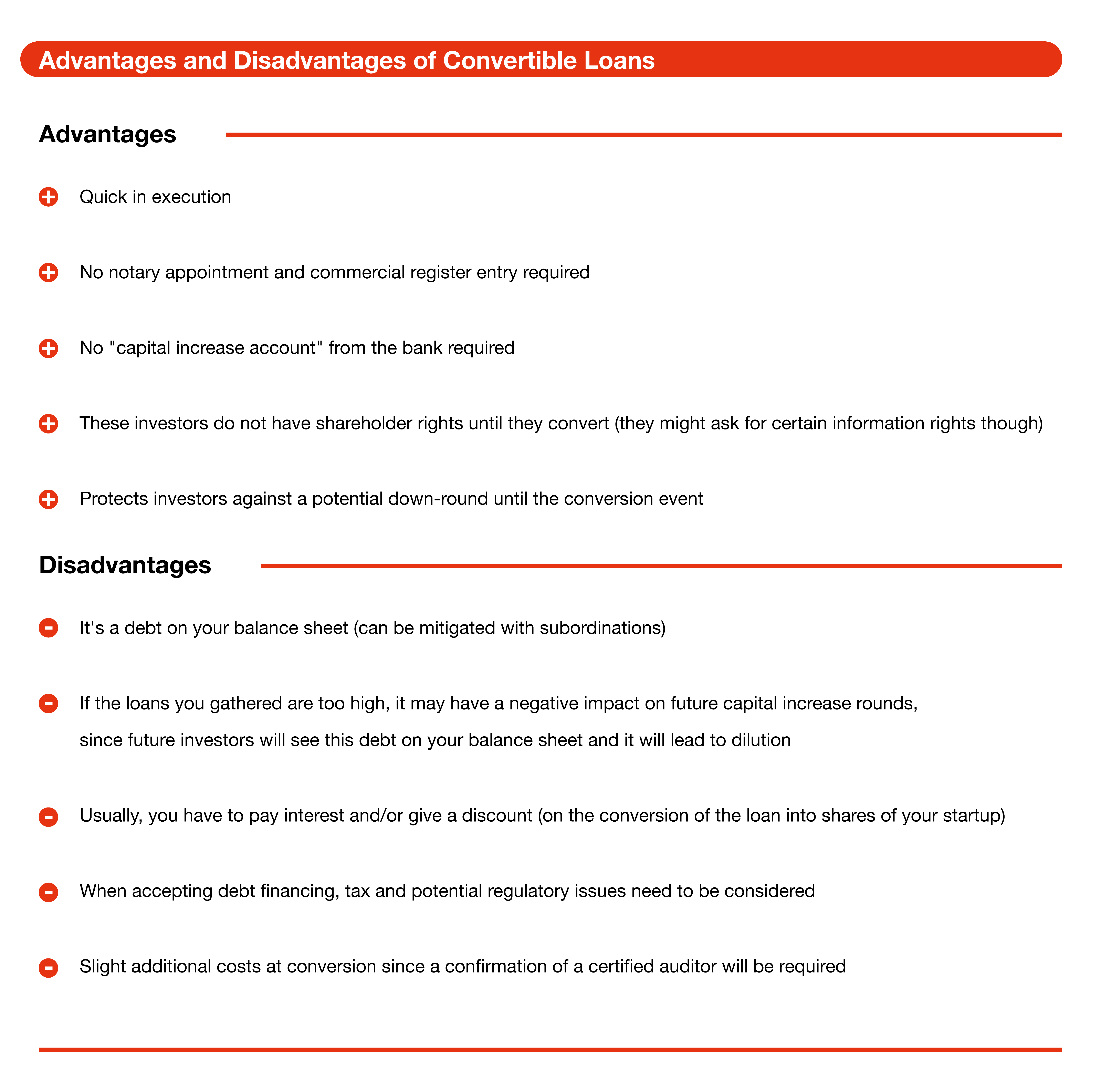

First things first, what is a convertible loan? A convertible loan is the perfect tool to receive cash quickly without having to manage a full capital increase along with all the legal work surrounding it (aka equity round). These loans are frequently used to bridge the time until closing of a financing round (by existing shareholders) when a full equity round is underway. Convertible loans can also be used to quickly bring in new investors and to postpone the formal share issuance process. But of course, a convertible loan also has its drawbacks as well as advantages.

In this article, we will walk you through the most important elements of a convertible loan. In addition to the advantages and disadvantages of convertible loans, you’ll also find information on topics such as interest rate, maturity date, conversion trigger events, discount, valuation caps, sales transaction and subordination. Let´s explore and make sure you get in touch if you have any questions.

Once you think about implementing a stock option program, we highly recommend consulting a professional lawyer who has extensive startup experience. Their background is important because some terms are special to startups and these lawyers have probably already seen what can go wrong in life.

Here is a list of professionals (we do not take responsibility for the quality of these lawyers).

Now that we understand the basic pros and cons, let´s get into the nitty-gritty of the key elements of convertible loans.

Interest Rates

Convertible loans, like others, usually come with an attached interest rate. This rate usually ranges between 1-5%, but professional venture debt investors might ask for significantly higher interests. We suggest to always have the interest rate checked by a lawyer or tax expert. The interest is usually not paid in cash but will also be converted to equity once the full loan gets converted.

Maturity Date

The convertible loan has a maximum length of time – let’s assume three years. If no earlier trigger event occurs, then (as in the case of a mandatory convertible loan) the convertible has to be converted after the maturity date has been reached, which leads to a capital increase.

If the convertible loan is mandatorily convertible (at the discretion of the investor), then the convertible needs to be paid back on the maturity date. The terms of maturity dates are often pre-defined and consider at what condition or price the load converts if no prior trigger event has taken place. For example, a maturity date valuation price is usually agreed upon.

In any case, you should retain the right to, at any time, repay the loan without penalty payments prior to the maturity date. In most cases, early repayment is a non-issue, but if you get lucky and win the lottery, you want to be able to get the debt investors off your back!

Conversion Trigger Events

A trigger event defines what has to happen in order to cause an automatic or voluntary conversion of the convertible loan. The most obvious triggering event is the maturity date, but others there are others to consider as well.

For example, it can be defined that the next capital increase round will trigger the convertible loan to automatically convert or it would give the lender the right to convert. This can make a lot of sense since you plan ahead with investors and you want to reduce the amount of paperwork. Therefore, once you make a capital increase, you can simultaneously convert the open convertible loans.

There are many other frequently seen trigger events such as exit transactions and fulfilment of certain milestones. You are pretty much free to agree on the terms with your investor and define which are best for you!

Discounts

When an investor gives you money without enjoying shareholders’ rights, it is not unusual for them to ask for a discount in order to compensate for the additional risk they are taking. This also depends on if a loan accrues interest and if yes, at what rate. Instead of accruing interest, an investor could be happy with a discount.

Discounts given usually vary between 10% and 25%, and 15% to 20% are quite common rates.

These discounts give the current investors an advantage versus future ones and provide credits for the early risk-taking.

Valuation Cap

Since investors at an early stage are taking risks without receiving full rights, they might request to have a valuation cap in place. What does this mean?

![]()

Convertible Loan Example:

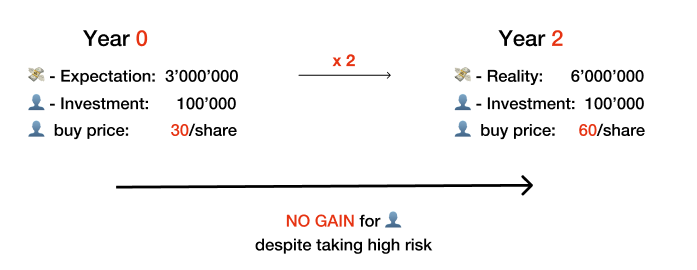

Funding round without Cap

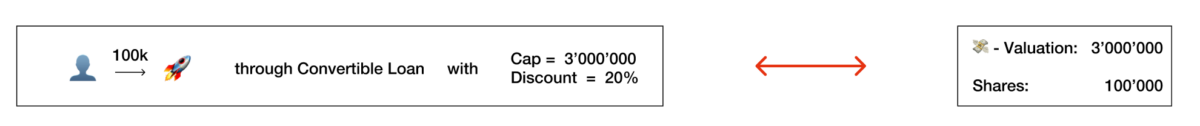

Let’s say an investor gives you 100K through a convertible loan.

Your business is developing better than expected and you are able to raise money at a much higher valuation than anticipated. Let’s assume you raise the additional money two years after you received the 100K and your valuation has multiplied by a factor 2, without a cap. The 100K investment would convert at that factor 2 valuation, which means all risk and no gain for the investor. But they still had to carry all that risk to just get there. This is why investors almost always demand a cap.

Funding round with Cap and Discount

Let’s say the current valuation is set at 3M, so investors may ask for a 3M cap. Therefore, even if the investor converts his 100k at a later capital increase event, where the companies value grew to 6M, the investor can still convert his investment at the 3M valuation. In our scenario, the price per share would be 30. Therefore the investor converts his 100k at 30/share. Any new investor joining during this funding round would pay 60/share.

If your business on the other hand is not going as well as planned and you have to raise funds at a valuation below 3M, let’s say 2M, then the investor would only pay 20/share even though his cap is at 30/share.

Funding round with Cap, without Discount

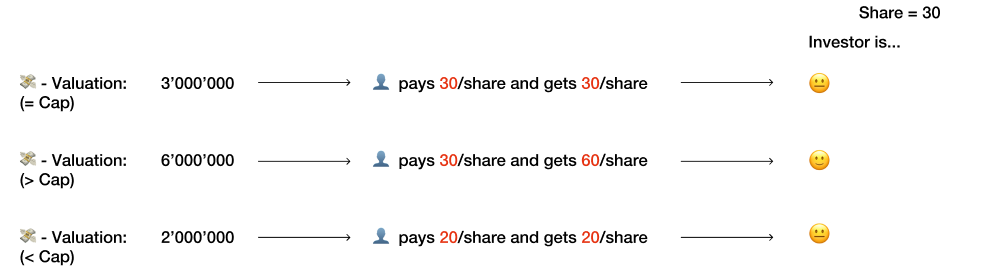

Funding round valuation Cap 3M & 20% discount

A discount means that an investor gets a cheaper price/share than other investors at the conversion event. Let’s say the investor agreed to a 3M cap valuation and a 20% discount.

If the funding round valuation is below or equal to 3M, then the investor converts his cash to shares at a maximum valuation of 2.4M due to his 20% discount benefit. The graphic shows three scenarios, based on conversion conditions.

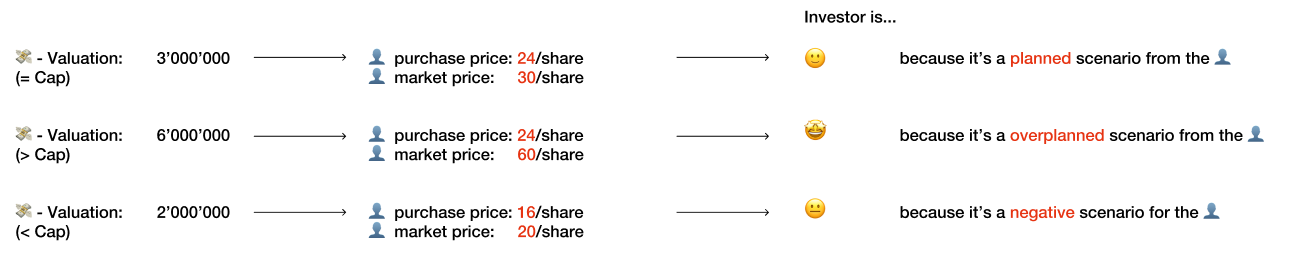

Funding round with New Investor

The reason why it is ok for a new investor to potentially pay a higher or regular price is that a “senior” investor who joined in the previous has already carried risk for some time. In other words, the new investor buys in, on what has been built already with the senior investors’ money.

![]()

Sale Transactions

In some cases, it can happen that a company gets sold before a conversion trigger event happens. The “sale transaction clause” defines what happens in these situations.

Usually, a discount rate applied to a sale transaction is agreed upon and the convertible loan automatically converts before the transaction (otherwise, an investor wouldn´t benefit from the sale transaction).

A sale transaction is also important in a fire sale scenario – ei in case of an emergency sale of the company and/or its assets. It can have any root cause, from a non-working business model to internal issues with founders or investors.

Subordination

Pay attention, this is really important!

Subordination means that investors will rank themselves behind other creditors.

If you do not have a subordination clause, it means that the convertible loan creates a normal debt which could trigger financial over-indebtedness which could lead your company to have to file for bankruptcy.

If you have a subordination, the convertible loan itself does not contribute to financial over-indebtedness. The debt would show up on your balance sheet, but it wouldn´t force you to secure that debt nor limit your credit rating.

Caution:

when using multiple convertibles at the same time. There is a legal limitation of how many active convertible loans you can have. If you violate these rules, your company may be shut down by the officials or face tax consequences!

You’re not allowed to carry more than 10 identical loans and you are also not allowed to have more than 20 loans in total. If you have more than 20 and pay interest on the loan, then you are qualified as a bank and since you do not have a bank license you violate Swiss financial market laws. Check out this short article on the potential legal and tax pitfalls of debt financing for startups. This rule is specific to Switzerland.

AUTHOR

Julian Stylianou

CONTRIBUTERS

Michael Baier

Max Bieri

Michael Mosiman

Adele Bottoni