An overview of Term Sheets

This article briefly explains the purpose of a term sheet and its content items.

There are definitely more interesting topics to talk about than terms and conditions regarding financing agreements. Nevertheless, it is necessary to understand key legal documents and their implications. If you neglect them, it might hit you hard at a later point in time. When that happens, you will neither have the nerves nor the time to sort things out. Promised.

Term sheets are key contracts to understand when talking to interested investors. This guide will help you understand the key terms and their implications. You will learn what a term sheet is, how to use it, what topics it covers, and what kind of share classes exist.

Once you negotiate terms with investors, we highly recommend consulting a professional lawyer who has extensive startup experience. Their background is important because some terms are special to startups and these lawyers have probably already seen what can go wrong in life.

Here is a list of professionals (we do not take responsibility for the quality of these lawyers).

In most cases, a financing round involves multiple investors. Therefore, your job is to align them and get them to agree to the same conditions. Since there may be many, each investor will confirm their investment appetite at a different point in time.

The more detailed the better

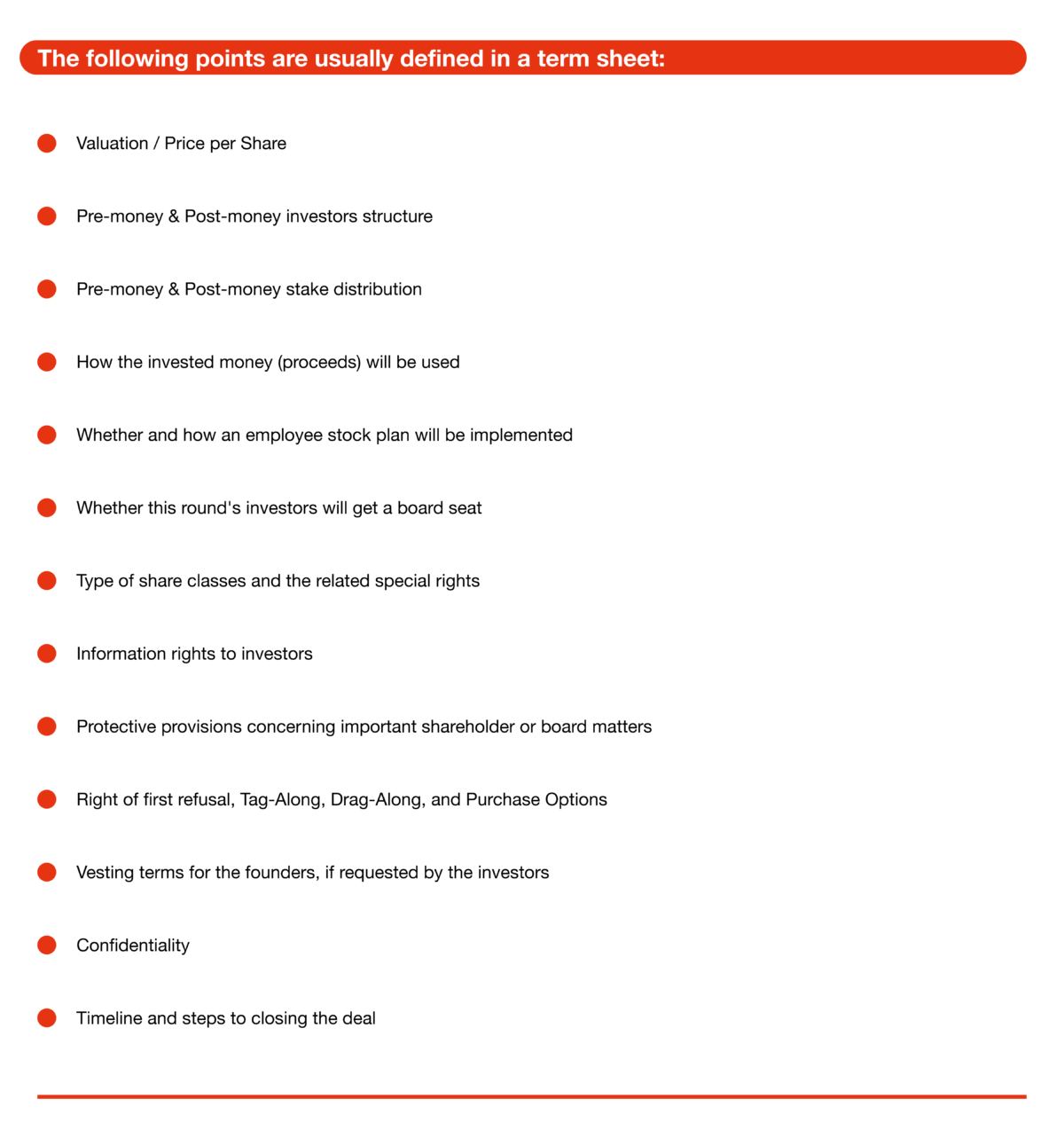

The term sheet helps you to pre-agree on the commercial terms for the following deal, without having to finalize all legal documents. This does not mean that you can avoid critical and time-consuming discussions. The more detailed a term sheet is, the fewer discussions you will have later on when drafting and negotiating the agreements, and vice versa.

Remaining on a very high level in the term sheet usually results in longer discussions on the agreement level or might even terminate the negotiations at a time when you have already accrued costs to draft and negotiate the agreements. It is better to tackle the nasty parts as early as possible if needed with professional advisors (this will usually save you money down the road).

Be sure you want to make that deal

A term sheet is usually non-binding, but once signed it signifies a very strong intention and signal from the investor (and the startup). Withdrawing from such a term sheet without good reasons becomes de facto impossible and could result in significant reputational damage. Investors and founders should only sign this document if they really want to make that deal.

It is also important that you do not just sign up for a deal to get funding as soon as possible, maybe out of desperation. Make sure you start your fund-raising process early in order not to run out of liquidity in the middle of the negotiations and only sign a term sheet if you are convinced that this is the right deal.

Ideally, all interested investors sign the same paper. Once the first investors have signed the document, it also helps to convince others to join for the same conditions by building confidence to join pre-negotiated terms.

The terms are usually negotiated with the lead investor. The lead investor is the one who invests the largest amount and/or which takes the lead in terms of communication and negotiation with the startup. It is relatively common that the lead investor takes a board seat (but this is not carved in stone as each case is different).

Other topics that are reflected in an investment and/or shareholders’ agreement may also be asked to be already defined in a term sheet.

Share classes

Common shares

When you incorporate your company you usually only have one share class (common shares). All shares have the same voting rights and participation rights. It is simple and fair.

Preferred shares

Now, if you negotiate with investors and they risk their money they may likely ask to receive preferred shares (as opposed to common shares). These are different because special rights are assigned to them. Preferred Shares are usually issued in the Series A financing round, and only occasionally in seed financing rounds.

Liquidation preference

Investors may also ask for a liquidation preference.

This usually means that in any liquidation event of the company, good or bad, the owner of preferred shares will receive their investment money first. If there is something left to distribute, it will be split among the other or remaining shareholders following a pre-agreed distribution mechanism.

It gives additional security to the investor in case of a bad case scenario and reflects the risk he takes when investing.

Most common (at least for early-stage investments) is the request for a one-time non-participating liquidation preference, everything else has to be looked at on an individual basis.

AUTHOR

Julian Stylianou

CONTRIBUTORS

Ioana Voicu

Michael Mosiman

Adele Bottoni