How to get funding in Switzerland…

… to make it easier to navigate through the jungle.

This document acts as a starter guide for new entrepreneurs and founders of startups seeking funding. The following pages explain what to consider before going into fundraising, which steps you should take prior to your active search for funding, which methods exist and how they can lead to success. Further, a list containing pro’s and con’s to take into account has been added for every method, enabling you to quickly gain an overview of the different phases and their prerequisites. In addition, a list of useful resources is provided for every phase.

In order to grow your business, you will need funding. Unless you have a rich family, it can be very challenging and frustrating to find investors. Many startups fail in doing so. This document gives you a rough guide on how to improve your chances of being successful. We cover the funding process from the very beginning to Seed. After you completed the Seed stage, you can go on to Series A, where you should have a well-established network to help you with future rounds.

This guide only briefly covers the subjects ‘Pitch Decks’ and ‘Terms & Legal’. It does not touch on the issue of proper valuation. Since these are important topics you should know about, we are creating separate guides for them. You will be able to find them on the SSA website as soon as they are ready.

Foreword

In order to be able to raise funds, your story has to be relatable and appealing. Startups carry a higher risk compared to established companies and therefore the potential return has to be larger for investors.

You need to articulate a clear value proposition, solid unit economics, a comprehensible growth story, and present a great team that is capable of implementing the business plan. Your story has to be so compelling that investors get a feeling of missing out if they do not invest.

For the execution and funding of your business, time management is very important.

The clock starts to run against you, once you receive the first funding. It is like in chess; once you make the first move, the time is compressing.

Financing rounds can easily take 6 months or more to be realized. Many startups have failed because they ran out of cash before they could sign the necessary funding. Investors will likely become aware of your urgent funding needs and therefore will leverage their position to negotiate favorable terms. Sometimes you don’t have many choices, but if you can manage your financing process well, it certainly gives you an advantage.

The earlier you are in building your company, the more it is a decision based on people. As an investor, do I believe that you can pull it off? Do I trust your team? Can this business ever reach a high profit or valuation? The further down the road you go, the more people look at your actual traction.

Keep in mind that certain stages, such as bootstrapping, can be skipped under circumstances. If your network is strong enough, you could start with FFF or even early-stage business angels investments.

Forms of financing

You should be aware of different alternatives, such as convertible loans versus capital increase. A capital increase issues new equity in exchange. A convertible loan is a debt that can sometimes be paid back, but usually converts into equity.

Debt financing through a bank is practically impossible until you are cash flow positive.

Convertible loans

Convertible loans are used when founders want to postpone a full capital increase process until a later point in time. It is common that startups start to finance themselves with convertible loans.

Investors benefit from this form of financing, as they usually get their future shares at a discounted rate. Founders can accelerate the funding process. Convertible loans are often used for bridging finance prior to a funding round.

Capital increase

A different practice of financing is the capital increase. In that case, a company offers its investors an increase of their pre-existing shares in the company in exchange for cash. As a result, each shareholder’s stake gets diluted but in a positive case, the value of the individual stake increases.

This process takes some time to complete and proper legal paperwork.

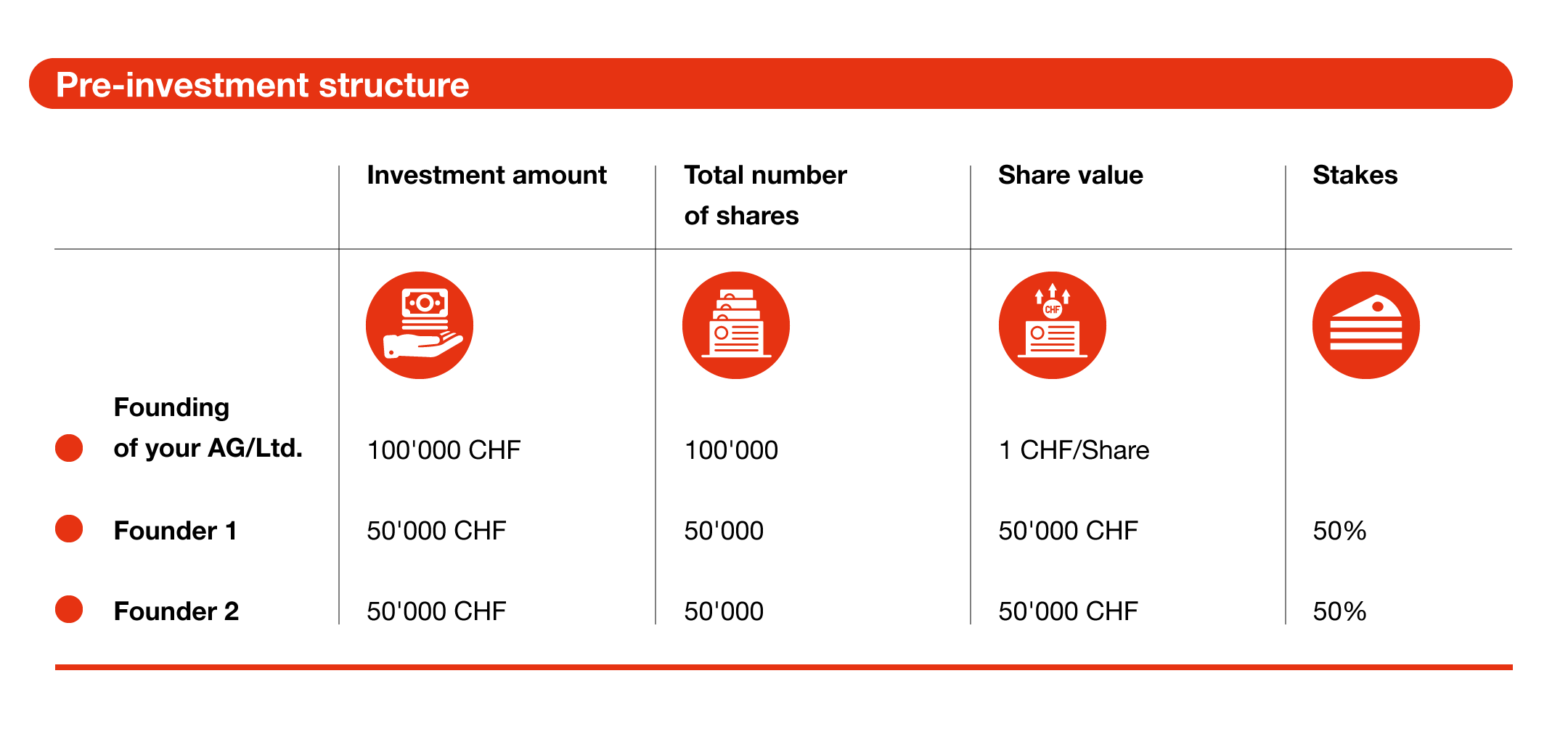

An example of how a capital increase affects your share structure (cap table):

Pre-money (before the investment) structure:

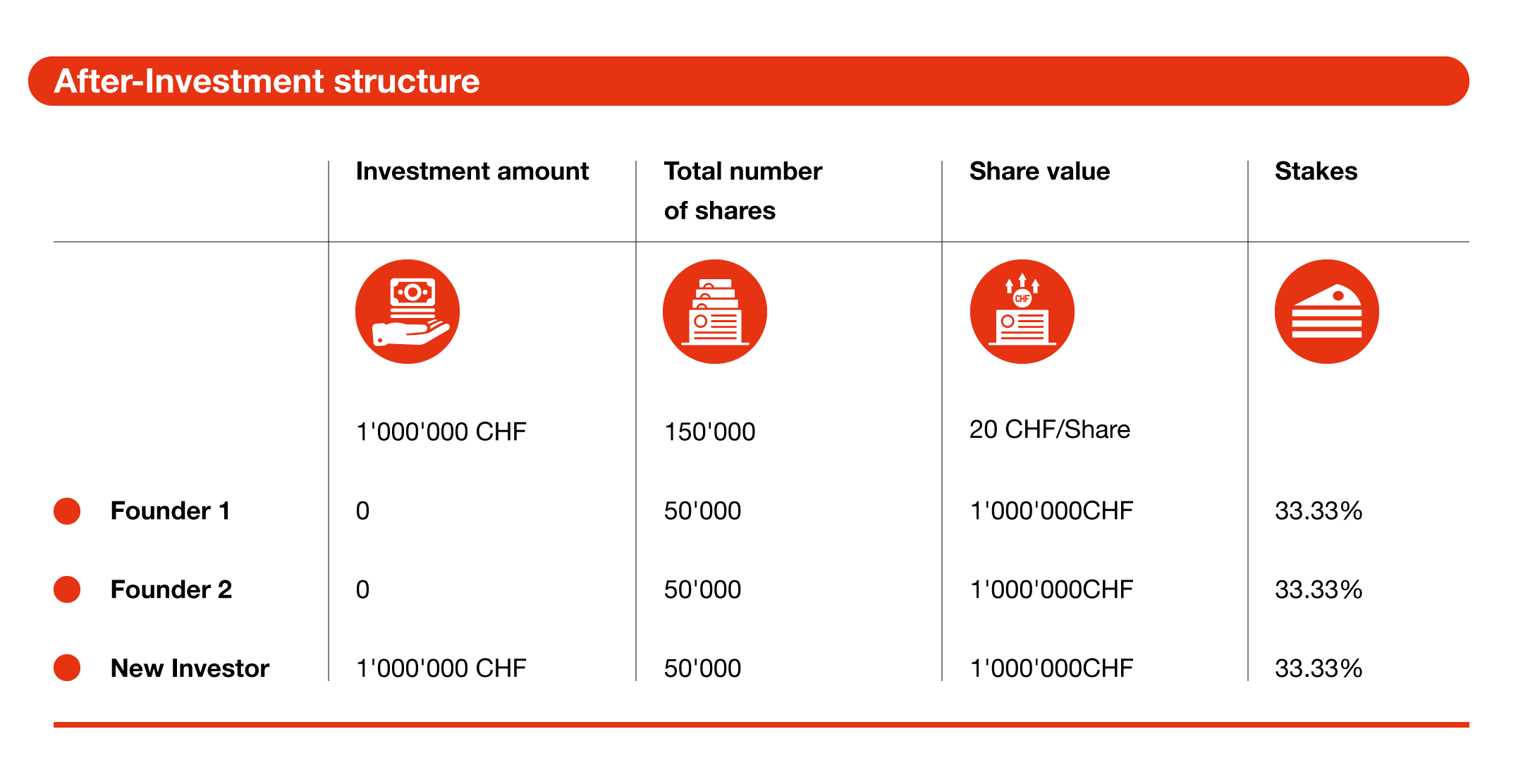

Now you develop your product with your 100’000 CHF cash and invest your blood, sweat, cry and reach out to investors to raise 1M in funds. You find someone who loves your product and is ready to invest 1M at a valuation of 2M. The 2M is the so-called pre-money valuation (valuation before the investment)

Post-money valuation (after the investment has been made) = 3’000’000 CHF

Congratulations, you are now a paper millionaire. It is this value because an investor invested at that price, but it is not an asset that you can borrow a loan on. The value only becomes 1:1 real when there is someone buying a stake or the full company. Investing is not equal to buying a stake. Investing increases the number of shares of the company and buying means buying current shares from current investors.

Crowdfunding

As an option, founders can also look into crowdfunding. At first, it can look very appealing. Unfortunately, it takes a long time and extensive work, plus it often does not generate enough money to compensate for the resources used. For some startups, it may really make sense to go with crowdfunding, but it is certainly not a one-size-fits-all funding source. There are two different kinds of crowdfunding.

Project crowdfunding is when people give you money for one specific project, for example writing a book, and then receive a copy of the finished product in exchange.

With equity crowdfunding, the investor receives an equity stake of your company in exchange for their money. There are different platforms for each kind of crowdfunding listed here in our resources list. Equity crowdfunding platforms often act in a similar manner as traditional VC’s, meaning that you need to have solid traction as well, before even being accepted as a crowdfunding project.

Types of investors

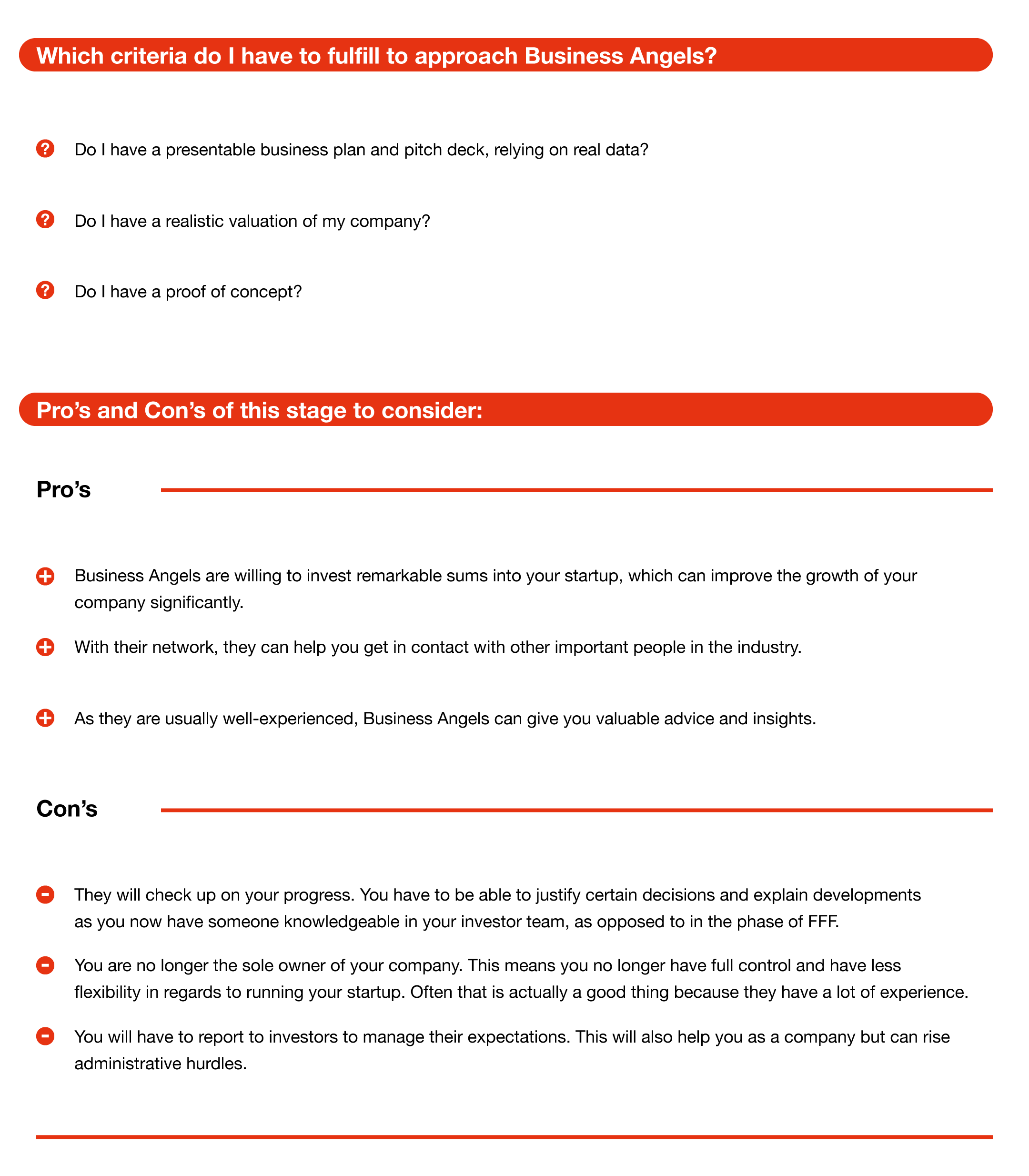

Business Angels (BA)

Business Angels are experienced businessmen or -women, who choose to invest in startups with their private assets. In return, they receive a share of your company. As opposed to Venture Capitalists, Business Angels are ready to invest in startups with little traction yet. Founders benefit from their investment, but also from their network and experience. Therefore, it is important to choose the right business angels in order to be able to profit from their network. Moreover, keep in mind to do due diligence on any Business Angel before accepting them as your investor. In contrast to dumb FFF money, Business Angels should provide smart money. It means they can help you build your company, for example by giving you access to important network contacts. They can really make a difference.

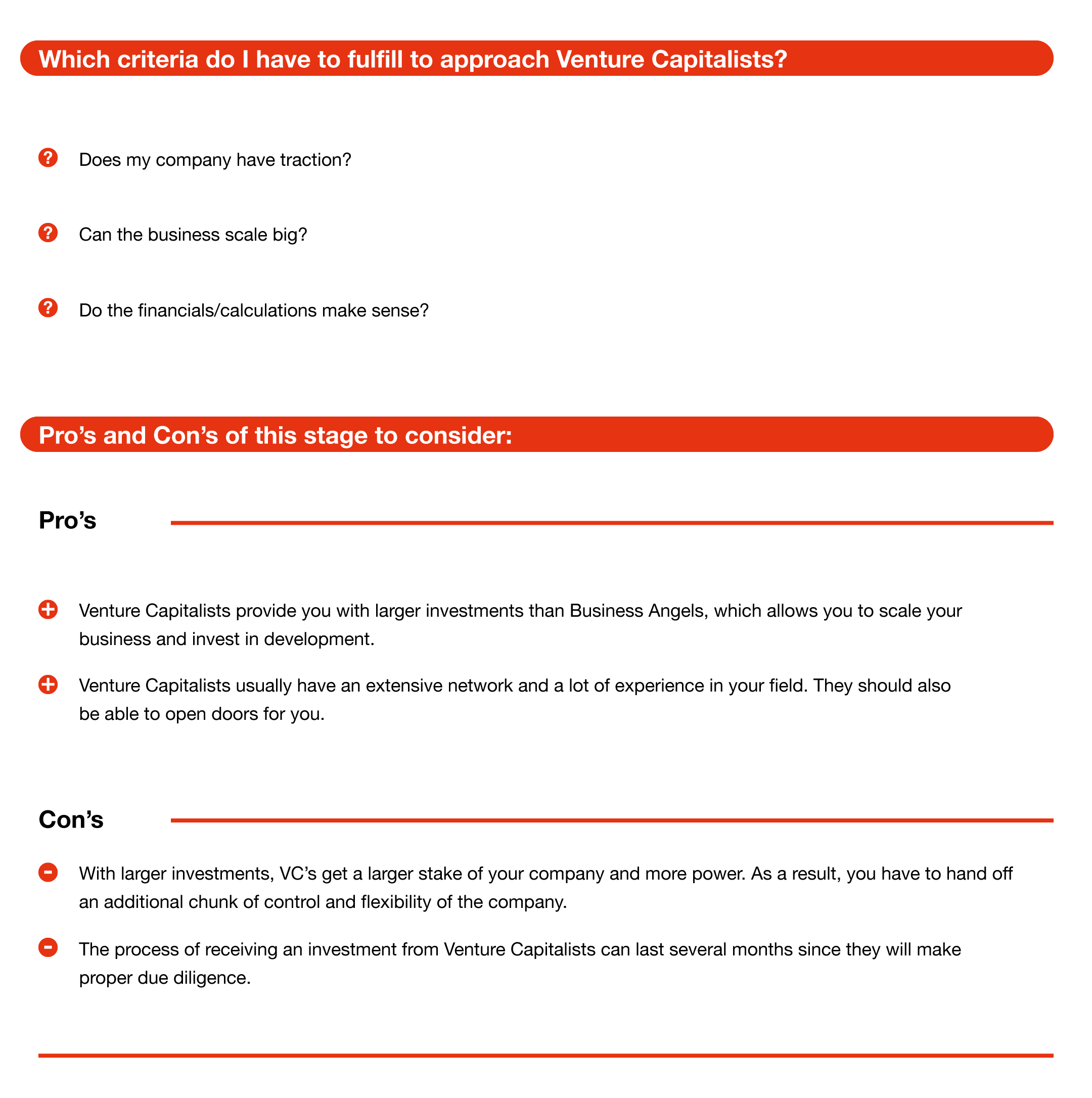

Venture Capitalists (VC)

Opposed to BA’s, VC’s would only invest if you already have some sort of solid traction.

It is important to understand how VC’s operate and which goals they have. When setting up a fund, VC’s set out to mobilize their investing partners. The amounts of money in the fund usually come from pension schemes, insurance companies, finance firms, very wealthy individuals and institutional investors. The aim of a fund is to generate profit within a time frame of 7-10 years, although only about the first 4 years are used to actively invest. Additionally, around 50% of a fund is reserved for follow-up investments in portfolio companies. A VC usually has multiple funds running at the same time, although only one might be available for new investments.

Because of that, it is important that you find out how old the specific fund is you would be applying to, before actually contacting a VC. This will save you a lot of time and effort. After around Year 4, most of the fund’s money will most likely already have been invested, leaving you with not much hope for a potential investment in your company. Be aware that not all VC’s invest in all startup stages. Many VC’s only start to invest from Series A on.

Startups that receive funding from VC’s have to consider the additional pressure that this investment comes with. Because of their structure, VC’s have to make thorough due diligence in order to keep up with the expectations and regulations of their investors. VC’s aim to achieve a high and quick exit. As follows, a company’s performance often has more weight than its story.

Family Offices

Family offices are wealth management firms that manage and increase the returns of families and individuals by investing in different assets. Usually, they do not have the specific capability to value and manage early-stage startup investments. Therefore, if they diversify their portfolio and invest in startups, they would do so via VC funds, but sometimes they also choose to invest in startups directly. For example, if they have a certain affinity to a specific industry. As of today, there is no public listing of family offices that invest in startups. An early-stage investment is highly dependent on personal relationships and network.

Institutional investors

Companies also provide funds to startups as institutional investors. They have a lot of power in the field of investing because of their assets and influence in their respective industry. Any company in the area of interest could potentially be a strategic partner to work with and my desire to invest in your venture. Also, it is smarter to choose a strategic partner as an investor than a VC’s. At the same time, it might limit your exit potential as competitors of your strategic partner would not invest in you anymore. As a result, if you go with a strategic partner, VC’s are very reluctant to invest at a later stage, because it may limit the exit potential.

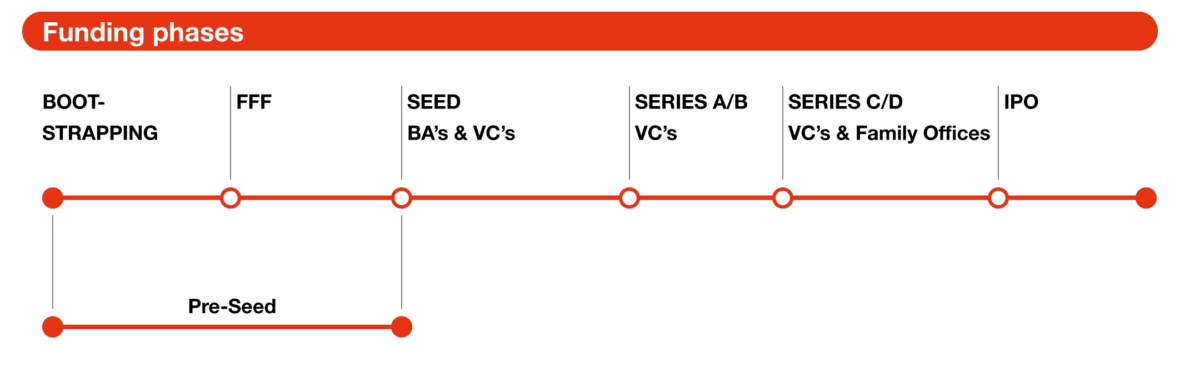

The funding phases

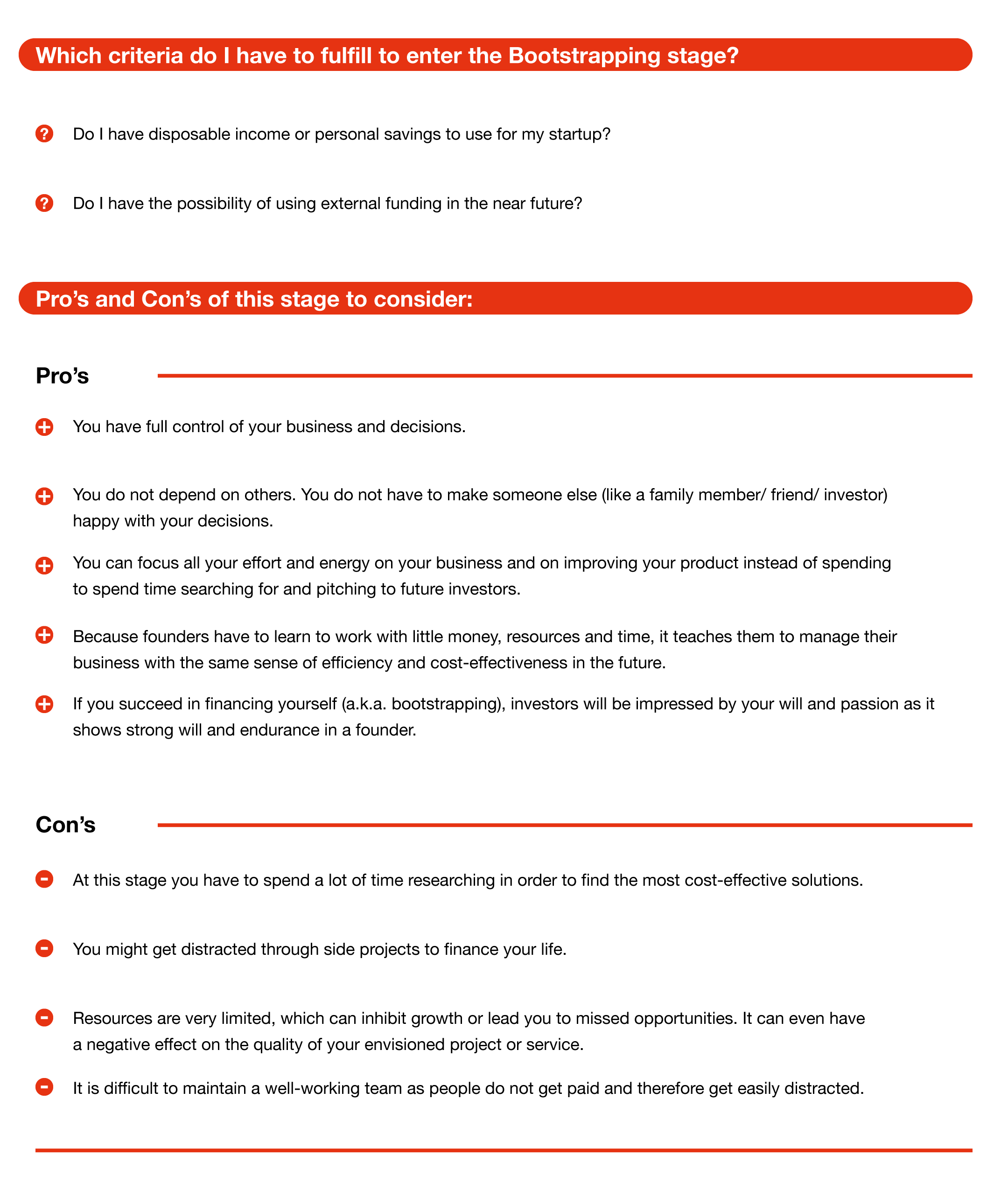

3.1 Bootstrapping

What is it?

Bootstrapping is the first phase founders enter when they want to start their company. In order to build a product or service, you need financing. At this point, you essentially try to implement your project with a very limited budget, aiming to minimise your expenses while maximising results.

In this first stage, founders essentially finance their own company without the help of external funding, meaning you make use of personal savings. Practically speaking, this means you get your startup going as a side project in order to maintain positive cash flow privately. Also, you could go all-in and live off your savings.

At this stage, there are opportunities to enter price competitions or apply for awards. Your university where you study or graduated from might provide valuable startup programs and benefits as well. If one of these endeavours proves to be successful, it will leave you with some extra money to invest in your venture. You can also attend specific events, where you have the opportunity to meet people active in the startup and investing field. Gatherings provide great chances to network, get valuable insights and feedback for your venture. Looking into early support programs is also an option to consider, as they make it easier for you to get your first funding experience. We have created a list of incubators, accelerators, events and competitions active in Switzerland here.

The goal of this phase is to bring the project to a stage at which people would buy the product or service, even though a pilot version might not even exist yet.

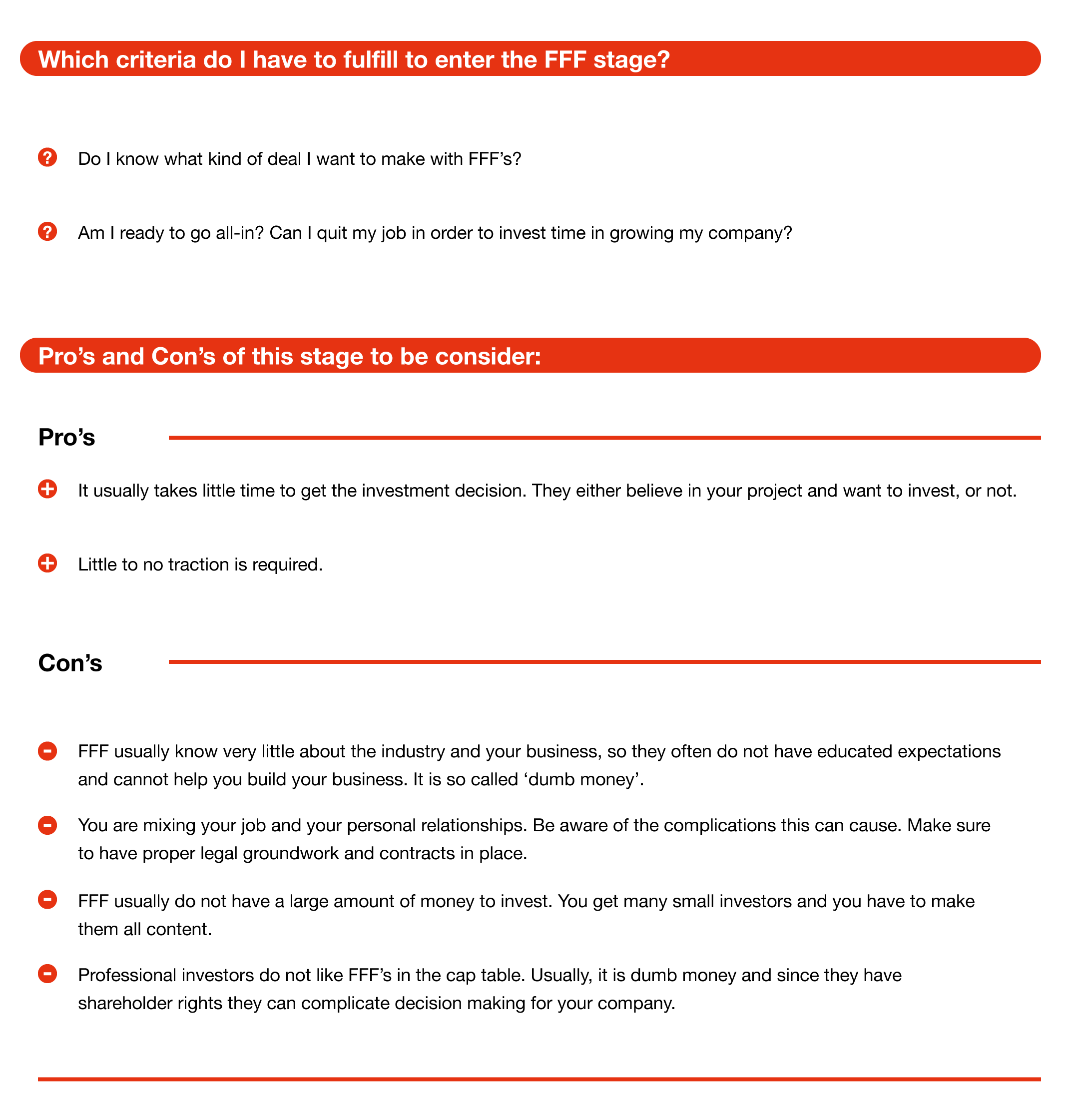

3.2 Friends, Family + Fools

FFF (Friends, Family, Fools) is the second phase founders enter. You should make sure you trust that now is the right time to dedicate more of your resources to build your business. Right now, you raise money from your personal network. You can ask friends and family to support your business with a financial contribution.

These early-stage supporters usually invest because they believe in you and your project. That is where the part of ‘fools’ comes in – these people are not sophisticated investors and usually only know very little about the business.

Some foundations donate cash or provide loans to startups. So it is kind of a hidden 4th F. They usually give you funding because of altruistic motives. They do not aim for profit but want to promote innovation.

You probably quit your job at this point, in order to make the most of the funds given to you. With your FFF money, you should acquire your first paying customers or develop your technology to the next level; in other words, build first real traction.

Typical ticket sizes: min 10k – max 50k

Resources

- Your personal address book.

- Your LinkedIn Network. You may be surprised whom you know and who might be ready to invest.

3.3 Seed

What is it?

The third funding phase a founder enters is called the ‘Seed’ stage. Here money is needed for the execution. With Seed money, you should accomplish serious traction to enable you to go into Series A. The Seed stage proves the product-market fit and generates real business traction. Having a business plan and a correlating pitch deck, enables you to approach potential investors, such as Business Angels or Venture Capitalists. These investors usually support the startup not only with a financial investment but also with their time, expertise and network. In return, they receive an equity stake in your company.

The Seed stage brings your venture to the point where you are ready to scale. It means you have proved the mechanics of your business model and are now filling up your engine to grow.

Startups at this phase are reliant on investments from BA’s and VC’s because they do not qualify for bank loans. Credit institutions usually want balance sheets from the last three years and a profitable business in place before they grant loans. There are several Business Angel Clubs or Venture Capital organisations, which will connect you to potential investors. A list of them can be found here.

Before approaching Business Angels or Venture Capitalists, make sure your company and presentation have the following qualities:

Firstly, you need a compelling story. Does your pitch make sense? Why does the world need your startup, product or services?

Secondly, you need a vision. Where do you want to go?

Thirdly, your company has to have great growth potential. How big can it get?

Do you make the impression of being able to execute your vision? Would investors believe that you can do it?

Is the underlying data supporting your story?

These points are then reflected in a pitch deck. It is never about the pitch deck itself, it is always about the underlying story. Beautiful slides alone are never going to bring you an investor, it is rather a hygiene factor. For an extensive guide, consult our pitch deck guide.

Due Diligence

Before agreeing to an investment in your company, investors will complete a process called Due Diligence (DD). This means that investors research your company by checking your track record and other formal documents to make sure you are not hiding essential information from them, which could compromise the deal they are trying to make with you. They are confirming that they are making the right decision by investing in your company.

But not only investors do Due Diligence – founders should too! It is very important to inform yourself about what kind of people you are doing business with before signing a deal. Make sure that your values are aligned, you see eye-to-eye on important topics and that you will be able to cooperate. Will they bring value (apart from financial one) to your company? Does the investor dispose of a network your company can benefit from? Does he or she have knowledge of your industry that can help you? If you are giving away part of your company and the control of it, it is important that you get the most out of your deal.

Make sure to have important documents ready to aid a Business Angel’s or Venture Capitalist’s process of Due Diligence. Keep in mind that VC’s may take weeks to months to complete DD as they do it much more thoroughly than Business Angels would do.

Business Angels (BA)

Business Angels are usually experienced businessmen or -women, who choose to invest in startups with their private assets. In return, they receive a share of your company. Make sure that you also do a reference check on these investors. Some wannabe BA’s just waste your time, so it is not always easy to choose the right partners, especially if you are in urgent need of funding. Business Angels who do not understand the process of startup financing and startup value creation may disturb you with non-productive discussions. Great business angels though can really bring you to the next level. So watch out for smart money Business Angels.

Typical ticket sizes: 25k – 250k

You can find a list of Business Angel Clubs and Venture Capitalist Organizations in our SSA resources overview.

Seed stage Venture Capitalists (VC)

The procedure for getting an investment from Venture Capitalists is similar to Business Angles. The difference is that VC’s would only invest if you already have some sort of solid traction. As they usually make higher investments than Business Angels, they need to minimise their risks by choosing companies that already show measurable success. If you do not have solid traction yet, wait with contacting VC’s as you will most likely get a ‘NO’. When you decide to seek out Venture Capitalists, only talk to VC’s who generally invest in your sector or industry. Everything else is a waste of time.

Typical ticket sizes: 250k – 1M

Resources

You can find a list of Business Angel Clubs and Venture Capitalist Organizations in our SSA resources overview.

Mental readiness

Wear thick skin. Just because investors are called investors, does not mean that they throw around their money. They look at hundreds of cases and just pick a few ones. The environment is highly competitive.

Therefore keep in mind: A “NO” is never personal. It is not about people not liking you. A “NO” comes when the investor believes that he can find a better case.

At the same time, be aware that investing is a people-based decision, so ultimately every decision is at times subjective.

Be prepared to receive many rejections. Don’t ignore the rejections, try to learn from them. Ask for why they reject you. Sometimes you get really valuable feedback that can bring you forward. Personal dedication is crucial. Always behave professionally. Investors will feel your vibe, they want to invest in a winning team and they talk to other investors to collect opinions about you as a person. Sometimes investors really make what could be seen as stupid comments. It is easy to be negative and joke about someone else’s project. You should not feel offended though and try to keep improving.

Do not rejoice before the investors have transferred their funds to your startup’s account. You are swimming in a shark tank. Sometimes people change their mind at the last minute or something unexpected happens. Anything can still change even if the investors have already signed the deal. For example, a crazy global pandemic which completely changes the game for everyone involved. It is rarely the case that investors do not follow through a deal they agreed to, but again there is no guarantee that this will not happen.

Resources

We created a list containing major competitions, incubators and accelerators, Business Angel Clubs, Venture Capital Organisations and Crowdfunding platforms in Switzerland. You can find it here.

Other relevant guides SSA put together for you:

- T&C – what you need to know about Legal Terms & Conditions (coming soon)

- Valuation – How does it work (coming soon)

- Pitch Deck – how to master yours (coming soon)

- Due Diligence (coming soon)