Measuring Marketing’s Effectiveness

A quick tour of terminology, challenges and tips for startups

Marketing’s ultimate goal is to deliver revenue. Building the brand, awareness and consideration are all means to an end: revenue. How can Swiss startups measure the effectiveness of marketing in delivering revenue?

Harvard Business School tells us: To measure your marketing strategies, focus on their revenue impact and identify the key metrics that define success at each marketing funnel stage.

Sounds straightforward, but it’s not so easy. If you are struggling to accurately measure marketing’s effectiveness, rest assured that you are not alone. Despite numerous metrics and increasingly sophisticated analysis, there is actually no easy, accurate way to measure the effectiveness of marketing, either overall or for individual activities or campaigns. That applies to all companies: large, small and startups.

I spent years reporting on marketing effectiveness in a multinational. My role was created when the CMO, needing to report quarterly to the CEO, demanded a consistent, coherent quarterly report of marketing’s contribution to the business across campaigns, regions and over time. While we improved reporting and engaged some of the best (or best-known) consultants and analytics firms, we could never provide a quarterly report of marketing’s actual revenue contribution. And I would venture to say that no business can, for two reasons:

- The inability to identify incremental revenue due to marketing activities, and

-

The time lag between marketing activity (& spend) and revenue impacts

Marketing is not alone here – investments like R&D are also made to generate incremental and future returns. However, with marketing, there’s an expectation that we can evaluate, learn and take improvement action every quarter, month or even day.

Measuring the return on investment in marketing (and most activities) requires estimates and assumptions. And for startups and early-stage companies without any history, estimating is even more difficult, especially given limited budgets and resources, developing systems and data/processes, and rapid change.

Let’s discuss these challenges as we look at some of the key analytical metrics used.

TERMINOLOGY

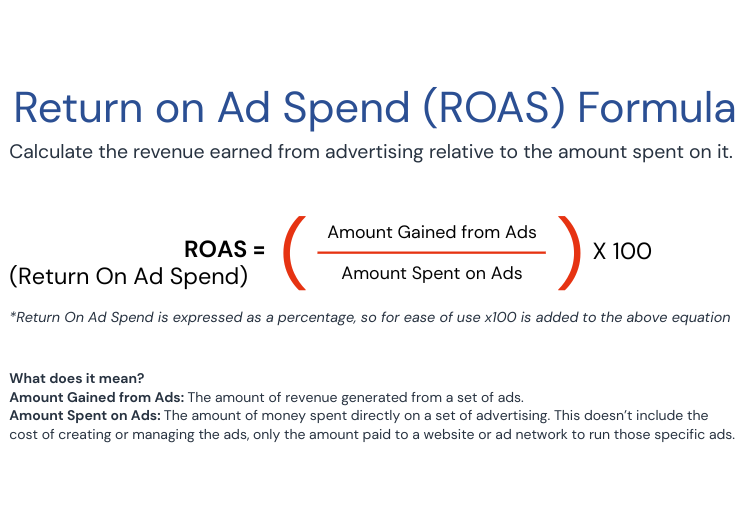

ROAS: Return on Ad Spend

Calculated as Revenue generated by Ads divided by Ad Spend. Often used in paid search.

ROAS is a revenue return, not the usual profit return as Finance would define “return”. It is essential to be clear on that definition and consider ROAS together with relevant costs, like COGS.

One can readily find recommendations that ROAS should be at least 4:1 for e-commerce/retail, 2:1 for high-margin industries and 1.5:1 for startups during the growth phase, but it depends on your situation and margin. Online wisdom also suggests 1:1 is break-even, but that would only apply if your revenue were 100% profit. (Don’t believe everything you read on the internet…)

However, the big challenge is what “generated by Ads” (meaning incremental) actually means. Paid search frequently uses click-based tracking to record all click-through revenue as being “generated by” ads in a ROAS calculation. Think about that massive assumption: have you ever searched for something you had already decided to buy, clicked on a paid search ad and purchased it? Would it be reasonable to attribute your purchase as “generated by” that paid search ad? Strictly speaking, that would mean you wouldn’t have bought it if the ad wasn’t there.

ROAS is worth monitoring; it can be appropriate for short sales cycles and conversion-oriented activities. However, there is a risk that ROAS overstates the value of activities late in a customer journey, like paid search.

Attribution Models

Model allocating credit to different marketing touchpoint in regenerating revenue.

Attribution models promise to help marketers understand which activities are most effective in driving conversions and allow better optimisation of spend.

They are multi-touch attribution models (MTA), an advance on a “last click” single-touch approach like ROAS. Revenue credit is attributed across trackable touchpoints in each purchaser’s journey. If an individual’s exposure to a marketing activity can’t be tracked (e.g., a billboard), it won’t be included. If you saw a billboard this morning, then later searched and clicked, the search or paid search gets the credit, which can be misleading.

For an attribution model, you’ll need to choose a model type, identify trackable touchpoints and define the rules or weightings for attribution. Results will reflect those weightings, whether estimates or based on analysis. While analysis-based weightings are logically better, it is crucial to understand how they are updated and whether they reflect changes like better creative, copy or targeting.

Attribution models can be useful, but remember the assumptions, limitations and the risk of focusing too much on the short term.

MROI: Marketing Return on Investment (or ROMI)

Calculated as Incremental Profit generated by marketing investment divided by marketing investment (cost).

MROI might be considered the ultimate effectiveness measure. The formula is simple – if only we could identify what is incremental to marketing activities. And then we need to consider the time lag between spend and returns.

MROI calculations therefore rely on estimates of incrementality, often based on assumptions or analysis. The result is modelled, not an actual measure of this month or quarter’s effectiveness.

Decisions must be made about what costs to include: creative development? salaries? net media or gross media?

Beware that online sources often use incremental revenue in MROI formulas. ROI calculations must use profit. Definitions and assumptions matter.

Marketing Mix Models (MMM)

MMM enable forecasting and optimisation of the planned mix of activities. They can include offline advertising, influencer marketing, PR, as well as non-marketing factors like price, distribution, economic shifts and competition.

MMM equations are built on past aggregated data and attempt to include lagged sales responses to upper-funnel activities. Historically expensive and data-heavy, MMM is now more accessible with AI and open-source tools. Still, startups need a consistent sales history, so simpler approaches like MTA or small experiments may be more feasible at first.

MMM can provide solid analysis-based estimates of incremental impact to justify budgets and confirm past spend delivered a return. But they remain modelled results based on past averages, not real-time measurement.

TIPS FOR SWISS STARTUPS

How to approach marketing effectiveness measurement:

- Define marketing objectives: the high-level aims such as increasing awareness or improving retention.

- Set clear measurable goals: what success looks like.

- Identify KPIs: measure progress towards goals. Awareness KPIs might include exposure, responses or website visits; conversion KPIs might be leads, purchases or click-to-buy rates.

- Understand all calculations, assumptions and limitations of your metrics. Focus on indicators that help you improve and make decisions.

Track and analyse performance:

- KPIs and metrics are indicators of progress, not actual revenue impact. They are useful for comparisons over time and across activities.

- Use analytical models (MTA, MMM) where appropriate, while remaining aware of assumptions.

- Look for opportunities to test using controlled experiments to identify better tactics.

Marketing is both an art and a science. Metrics and models are data-driven, but they cannot fully capture creative and emotional impact.