Cash Discipline Habits Every Founder Should Build

Most startups don’t die because the product is bad. They die because they run out of cash. That was the clear takeaway from our recent webinar featuring Peter Angelof (Leader of Emerging Growth Companies at Deloitte), Eve Partardai (Co-Head Turnaround & Restructuring at Deloitte) and Simon Furer (CFO of Voliro), showed what cash discipline really looks like for startup founders and finance leaders in Switzerland.

Why cash discipline matters now

For most startups, growth requires spending ahead of revenue. Your job as startup founder is not to stop spending; it’s to spend consciously so that every franc pushes you toward traction and the next milestone.

Peter explained in his presentation that cash flow and liquidity management is a top-one or top-two priority for founders, especially for the finance function within startups and scaleups. That mindset becomes critical when funding tightens and rounds take longer. Teams that treat cash like a product metric (not an accounting afterthought) stay in control.

He highlighted 5 recurring failure patterns:

- No forward view of cash and upcoming obligations

- Optimistic revenue booked, but collections lag

- No buffer for shocks (inventory, hiring, delays)

- Spend not prioritized against strategy

- Invoices sent late… or not sent at all

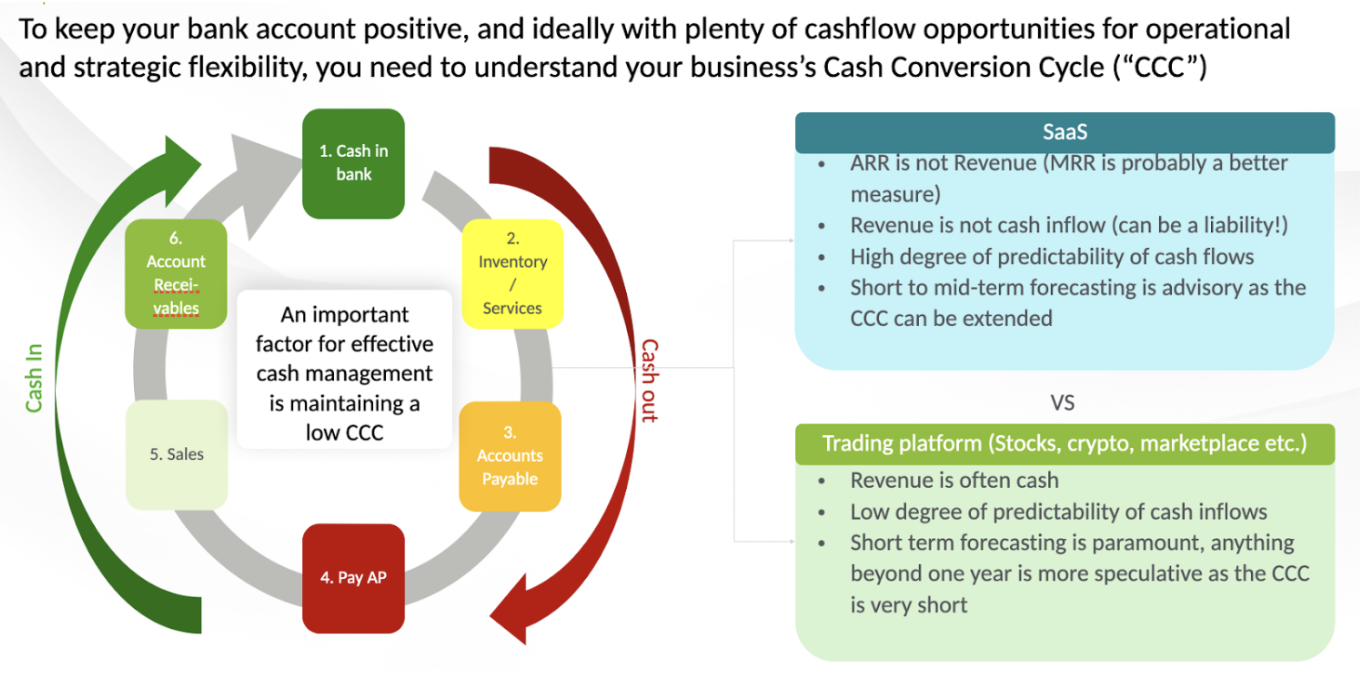

Cash Conversion Cycle

To keep your bank account positive, and ideally with plenty of flexibility for both daily operations and growth, every startup founder needs to understand the Cash Conversion Cycle (CCC). The CCC is the clock that starts when you pay suppliers or staff and stops only when the customer’s payment lands in your account. The shorter that cycle, the stronger your cash position.

Every business moves through the same loop:

- Cash in bank

- Inventory or service delivery

- Accounts payable (suppliers and contractors)

- Payment of AP – your cash goes out

- Sales

- Accounts receivable – waiting for customer payments to come in

An important factor for effective cash management is maintaining a low CCC – the less time between cash out and cash in, the better your liquidity.

Peter summed it up simply: You could potentially show tremendous revenue on your accounting software, but you could still be running out of cash.

SaaS vs. Trading Models

The right cash discipline depends on your business model:

- SaaS businesses often have predictable cash flows and a longer CCC, since revenue recognition and collections are spread over time.

- ARR is not cash – MRR is the better measure.

- Even signed revenue can be a liability until it’s collected.

- Medium-term forecasting is essential because the CCC is extended.

- Trading or marketplace models (stocks, crypto, e-commerce, etc.) work the opposite way:

- Revenue is often immediate cash.

- Forecasting beyond a few months becomes speculative because inflows are volatile and the CCC is short.

- Short-term forecasting and tight expense tracking matter most.

Regardless of model, cash flow management is not about hoarding cash, it’s about using it deliberately. As Peter reminded startup founders: “It’s about spending your cash wisely, because your investors entrusted you with their funds to fuel your scaling journey.”

How to Shorten the Cycle

Simon shared practical advice every founder can apply to build stronger cash discipline. “Most suppliers want cash now and customers want to pay late,” he explained. “So you need to keep that cycle as short as possible.” His approach focuses on managing both ends of the cash flow. Clients are invoiced upfront, often prepaying quarterly even before deployment, which covers hardware costs early. At the same time, Simon aligns supplier terms so that payments are made only once matching customer funds are received. This straightforward system turns a potential cash gap into a position of control and predictability.

Each month, Simon spends a few minutes logging into the company’s bank accounts, recording all cash balances, and calculating the net and gross burn. By dividing the cash on hand by the average burn rate, he knows exactly how many months of runway remain. “As a founder,” he emphasized, “you should never plan for a cash-out scenario. You should know precisely when you need to fundraise again.” It’s a simple spreadsheet habit that provides complete visibility into the company’s financial health.

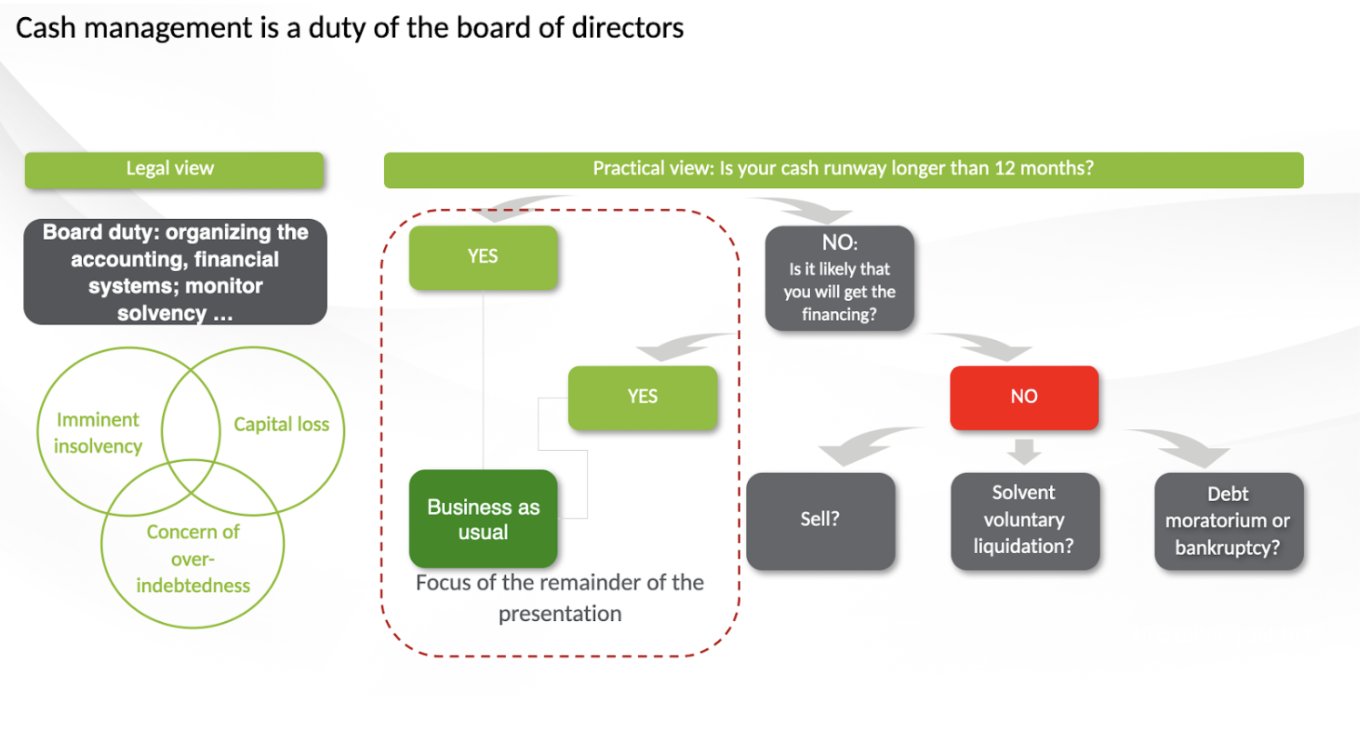

What Board of Directors must know

Eve reminded startup founders that solvency isn’t just good practice – it’s a duty of the Board of Directors that cannot be delegated. Here’s her rule of thumb:

- >12 months runway: business as usual

- <12 months but funding likely: execute plan, fundraise with urgency

- Funding unlikely: stop before entering obligations you can’t fulfill, especially with authorities (tax, social security)

Runway is not a feeling – it’s a timeline.

Build a Living Liquidity Forecast

For startup founders exploring finance software, remember that early-stage realities change weekly. Nothing beats the speed and flexibility of a simple spreadsheet. What matters most is financial discipline, not the tool itself. You don’t need fancy software to start; just open a spreadsheet and begin tracking:

- Beginning cash (from your actual bank balance – adjusted cash doesn’t exist, as Peter stresses)

- Cash in (from customers and investors)

- Cash out (suppliers, salaries, tools, rent)

- End cash (beginning + in − out)

Each month, overwrite the starting balance with your real bank statement, compare forecast vs. actuals, and adjust. Once that works, expand the model:

- Add open receivables and expected payment dates

- Track existing contracts and new pipeline assumptions

- Include cost categories like sales, marketing, people, development, G&A

Keep your model simple enough to update quickly – the point is consistency, not complexity.

Making everyone a steward of cash

Policies alone won’t save you. Therefore, you have to create budget guidelines instead of rigid rules, and teach “company-money thinking.” This means:

- Use guidelines, not punitive rules (e.g. 180 CHF/night for hotels)

- Add approval limits for large purchases

- Celebrate fast invoicing and collections

- Make cash awareness part of onboarding and all-hands

Your starter checklist

To stay on top of your startup’s finances, focus on simple, consistent habits from day one. Start by tracking your cash, monitoring key metrics, and enforcing thoughtful spending. Here’s a practical checklist to get started:

- Record day-one-of-month bank balances and compute runway

- Invoice upfront wherever possible

- Track MRR, gross burn, net burn, DSO, supplier terms

- Build a 12–18 month rolling cash view

- Add approval limits for big-ticket spend

- Make collections a weekly ritual

- Tie every expense to a strategic priority

Final Thoughts

As a startup founder you have to make sure that you have a clear view and control of your cash, and the rest will follow. Create a cash-control culture, keep your forecasting simple, and make fast, conscious decisions. The result is clarity – exactly what founders need when markets get noisy.

Catch the full webinar replay in our Educational library – free for Swiss Startup Association members.

Not a member yet? Explore our membership benefits and join Switzerland’s most active startup community.

Don’t miss out on the latest news and events. Subscribe to our newsletter and stay up to date.