Swiss Deep Tech Report 2025: Five Structural Signals for the Swiss Startup Community

Yesterday (June 26th), Deep Tech Nation, Founderful, Kickfund, startupticker.ch and dealroom.co published the Swiss Deep Tech Report 2025, the first longitudinal study that connects ten years of company data, patent activity, funding records and university spin-outs into one coherent picture of the Swiss science-driven startup landscape.

The dataset covers more than 1’500 ventures, traces investments from seed to public listing, and benchmarks Switzerland against leading innovation economies. The report’s timing is serendipitous: it appears at a moment when the Swiss Startup Association is intensifying its work on supporting growth-stage founders, access to capital, stock-option taxation and regulatory clarity. This article aims to isolate five structural signals that emerge from the numbers and situate them within the current startup debate.

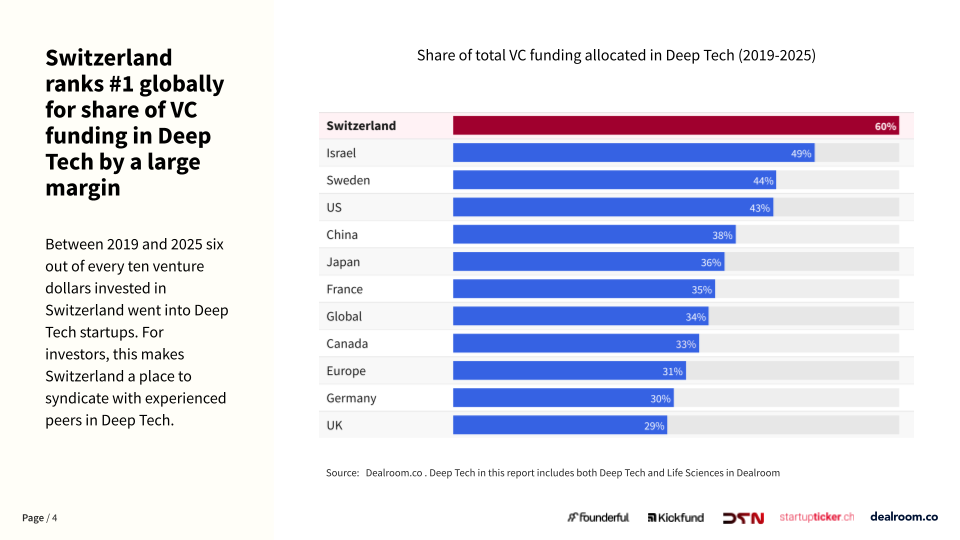

1. Deep Tech commands the majority of Swiss venture capital

Between 2014 and 2024 the annual flow of capital into Swiss Deep Tech multiplied six-fold, climbing from roughly 320 million USD to 1.9 billion USD, with 2.3 billion projected for 2025. Over the 2019-2025 window Deep Tech accounted for 60 percent of all domestic venture funding, the highest share recorded for any country. In per-capita terms Switzerland ranks first in Europe and third worldwide for Deep Tech funding.

These proportions signal a structural realignment. A decade ago, science-based companies were viewed as a specialised subset of the wider startup scene. Today they anchor the capital market and shape its expectations of growth and risk. The shift also influences public discourse: when policymakers or trade bodies speak about “startups”, statistical reality now dictates that they are often speaking about Deep Tech in particular.

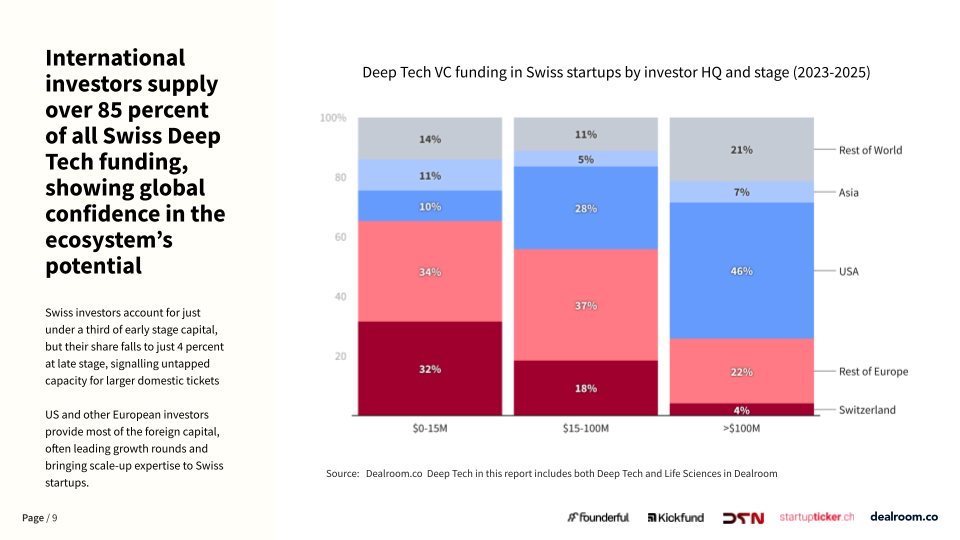

2. International investors dominate late-stage rounds

More than 85% of all Deep Tech venture dollars invested in Switzerland originate outside the country. At the growth stage the figure rises to 96%, with United States-based funds alone providing nearly half of the capital.

International participation brings market access, sector expertise and pricing discipline. It also exposes a clear gap in the domestic financial participation. The imbalance leaves governance influence and late-stage value capture largely in foreign hands. The Swiss Startup Association lists capital availability among its advocacy priorities; the figures in the report quantify both progress and dependence.

3. Research density converts predictably into company formation

ETH Zurich and EPFL appear among the top four European universities for Deep Tech spin-out value creation, trailing only Oxford and Cambridge. Switzerland also shows the highest density of recognised AI researchers per capita in Europe. The report links these academic assets to measurable entrepreneurial outcomes: more than 100 billion USD in aggregate enterprise value.

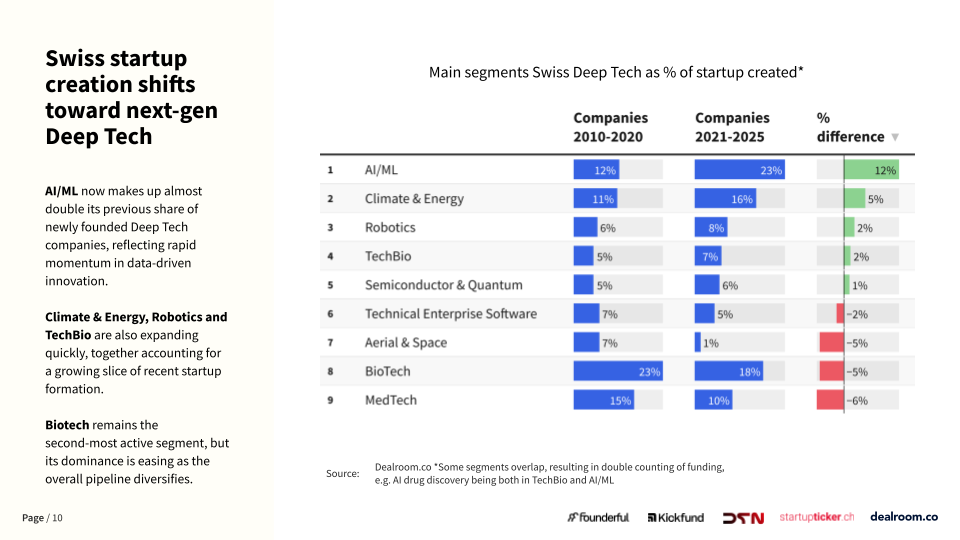

4. The sector mix is migrating toward computation-driven disciplines

Since 2021 artificial intelligence and machine learning account for 23 percent of newly founded Deep Tech companies, almost double their earlier share. Climate & Energy, Robotics and TechBio have also expanded, while traditional BioTech and MedTech decline slightly in relative terms.

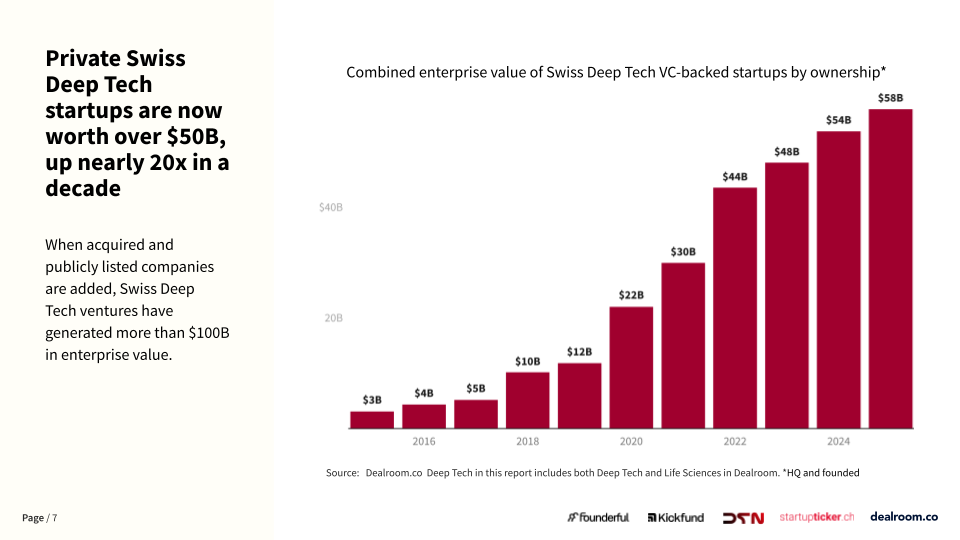

5. Deep Tech enterprise value is broad-based and cumulative

Swiss Deep Tech startups now surpass 100 billion USD in combined valuation. The tally aggregates venture-backed scale-ups and publicly listed companies in Deep Tech sectors. It confirms that the ecosystem does more than generate promising research projects; it sustains companies through multiple funding cycles and across economic downturns.

The Deep Tech decade

The Swiss Deep Tech Report 2025 brings statistical clarity to a narrative that was previously supported by anecdote and isolated case studies. It records a sustained transfer of knowledge from university laboratories into globally relevant companies, financed by a mix of domestic seed funds and foreign growth investors. It registers sectoral rotation toward computation-heavy fields and quantifies the economic weight that Deep Tech has acquired within the national venture market.

Switzerland enters the second half of the decade with a Deep Tech ecosystem that is internationally integrated yet firmly rooted in domestic research excellence. The figures leave little doubt: science-driven enterprise is no longer a peripheral ambition but a central pillar of the Swiss economy. The challenge now is to translate that pillar into durable global influence while safeguarding the conditions that allowed it to emerge in the first place.

Find the full report here: https://deeptechnation.ch/resources/swiss-deep-tech-report-2025/