Everything You Need to Know About Valuation Methods

If you want to grow your company, you will likely have to ask for funding from investors. And in order to get an investment from investors, you have to be able to provide them with a valuation for your startup. The way you communicate the price to pay (valuation) is important. Early-stage startups have too little data to create a data-based valuation, therefore, multiple possible approaches exist.

In this article, we will outline a few known methods and align them according to the startup stage. We also touch on some general tips that apply when evaluating your company. The aim of this guide is to provide you with an overview of the existing valuation models and to show you which ones make the most sense for your company.

General Info

Overall, it is essential to be able to justify your valuation. You have to be prepared to show potential investors how you calculated your valuation. Which model did you use? Why did you use that method? Which data did you draw from? How up-to-date is the data? By showing investors you did your homework and know what you are talking about, you add credibility, which will increase your chances of succeeding and improve your position in terms of the negotiations.

Keep in mind that especially during the first few phases up until Series A, the methods available to use are not very scientific and often a rule of thumb based valuations are being called. Because you do not dispose of enough reliable data yet that can be used to predict the success and growth of your company, it can be tricky to make any accurate predictions. Even though you might not have reliable data available yet, any form of traction (revenues, initial customers, partners, users) does of course support your valuation story.

Usual pre-seed to seed Business Angel rounds in Switzerland

In general, Angel based investment rounds will accept valuations between 1-3 million and an absolute maximum of 7 million(with 1 million being a very attractive priced deal for investors). Anything up to 3 million is usually very attractive and deals between 3-5 million require a very solid foundation to go through. Deals between 5-7 million are already exceptional. Deals above 7 million basically don’t happen, but of course, there are always exceptions.

Having said all of that, it’s a case by case discussion and of course, it highly depends on the quality of your traction-based story. First, worry about the traction, then worry about the right valuation. It should just give you a rough indication of what’s happening in the market. No matter what you do, a deal needs to make sense for a business angel. He needs to be able to acquire a reasonable stake because business angels usually help you with their passion, their know-how, and experience. If your valuation is too high, it doesn’t make sense for them to engage with you if they just receive a tiny fraction of the company. Having said that, you can also not give too much equity away, it has to be a balanced deal for both parties.

“My rule of thumb in terms of early-stage valuations is, 1M CHF for a strong team with a good concept targeting an attractive market. For a Startup with initial revenues/”Proof of Concept” or pilot customers, a valuation of 3-5M is reasonable.” – Ralph Mogicato, Vice President Sictic

“Our pre-money valuation limit at Business Angel Switzerland is 5M CHF. Anything above does not make sense for us to engage.

We usually look at three valuation methods. The VC-method, opportunity cost calculation, and Business Angel rule of thumb, where we look at the parameters cash investments for asset creation, prior financing, founder sweat equity, traction, and future potential. Having said that, the valuation is not our most important investment criteria, it is the underlying story.” – Dr. Johann Schlieper, President Business Angels Switzerland.

Valuation Models (List)

This is a list of the valuation methods you will find explained in this document.

Discounted Cash Flow Method (DCF)

Valuation Models per Stage

Each stage has its own perks and difficulties. When it comes to calculating the value of a company, what kind of method is used depends on which stage you are currently in, as well as the personal preference and experience of the investor. Due to the lack of historical data and experience, Pre-Seed and Seed startups need to use different valuation models than startups entering Series A, as these already dispose of data on traction and expected cash flows. These key figures allow for more scientific and mathematical approaches.

1. Pre-Seed & Seed

Berkus Method

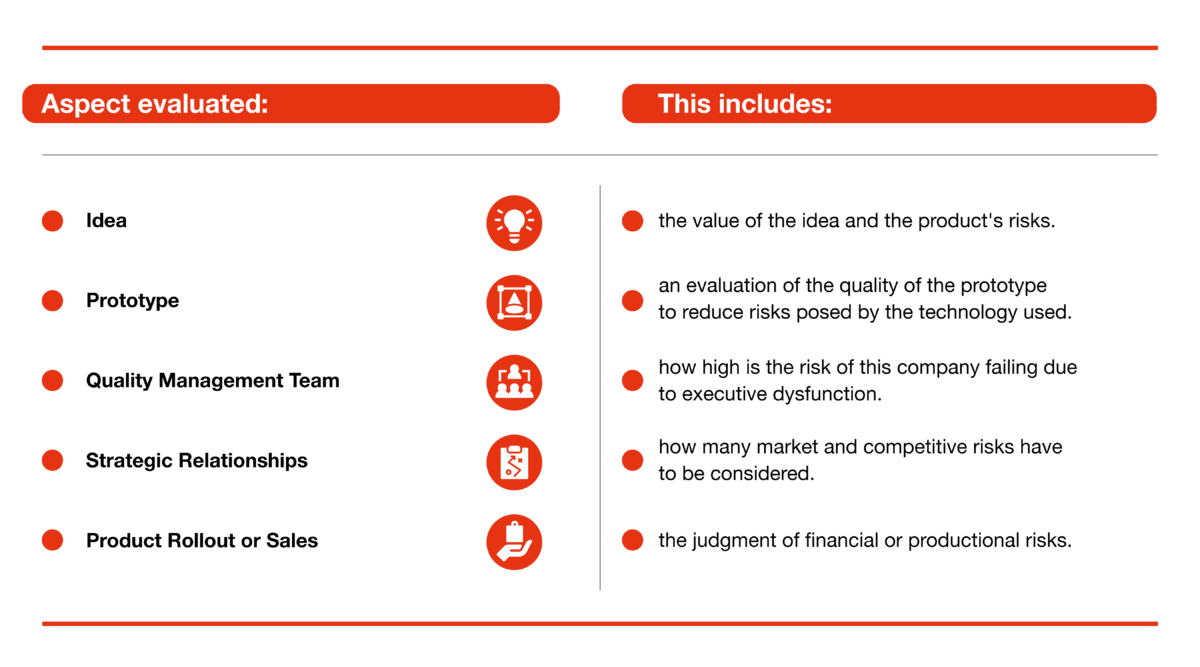

This method evaluates a company on the basis of five different aspects by assigning a certain amount of money (a.k.a value) per aspect, depending on the quality in which this aspect is present in the company. The aspects are as follows:

Depending on how high the quality of these aspects is rated by the investor, they will assign an amount of up to 500’000 CHF to each one. This method is especially valuable for startups that do not have much data to work with.

Scorecard Method

The Scorecard Method compares the startup in question to other, already funded similar startups. The valuation is adjusted to the specific startup by taking factors such as region, market, and stage into consideration.

Firstly, the average pre-money valuation of startups in the pre-revenue stage has to be determined, which is usually around CHF 1 million.

In the next step, certain qualities called comparison factors of the targeted startup are compared to other startups and their competitive value is then determined.

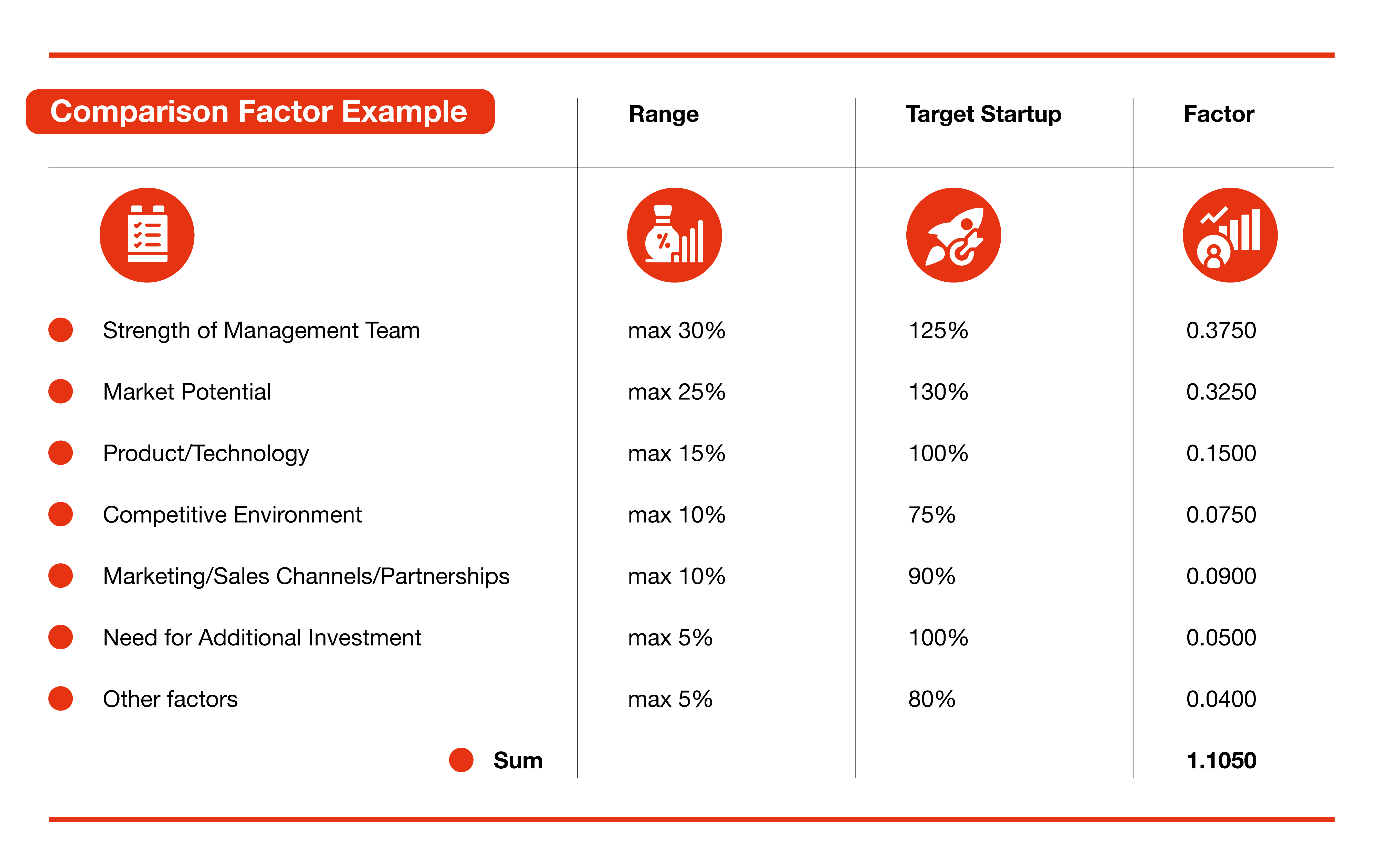

These factors include:

- Strength of Management Team: 0-30%

- Size of Opportunity: 0-25%

- Product/Technology: 0-15%

- Competitive Environment: 0-10%

- Marketing/Sales Channels/Partnerships: 0-10%

- Need for Additional Investment: 0-5%

- Other factors: 0-5%

Let’s look at an illustrated example:

We are looking at the comparison factor ‘Strength of Management Team’. The Scorecard Method assigns a percentage of 30% to it.

Now we compare the quality of the targeted startup (in which the angel wants to invest) team to other startups’ teams. If the team is seen as particularly capable in comparison, then this factor is assigned a percentage higher than 100%, for example, 125%. This factor is then multiplied by the 30% that were assigned to this quality in the beginning. That would leave us with a factor of 0.3750.

This step is repeated with each of the categories to judge.

In the end, all of the factors are added up in order to calculate the final factor. This number is then multiplied with the average pre-money valuation, which was determined in a prior step, to give us our final valuation.

Final Valuation = 1’000’000 CHF (average pre-money valuation of similar industry startups) x 1.1050 = 1’105’000 CHF

This method is well-suited for Pre-Seed valuation as it offers a way of valuation without having to use hard numbers. It also takes the future potential into account, which methods like the ‘Cost to Build’ method neglect for example. On the other hand, it is also a rather subjective method.

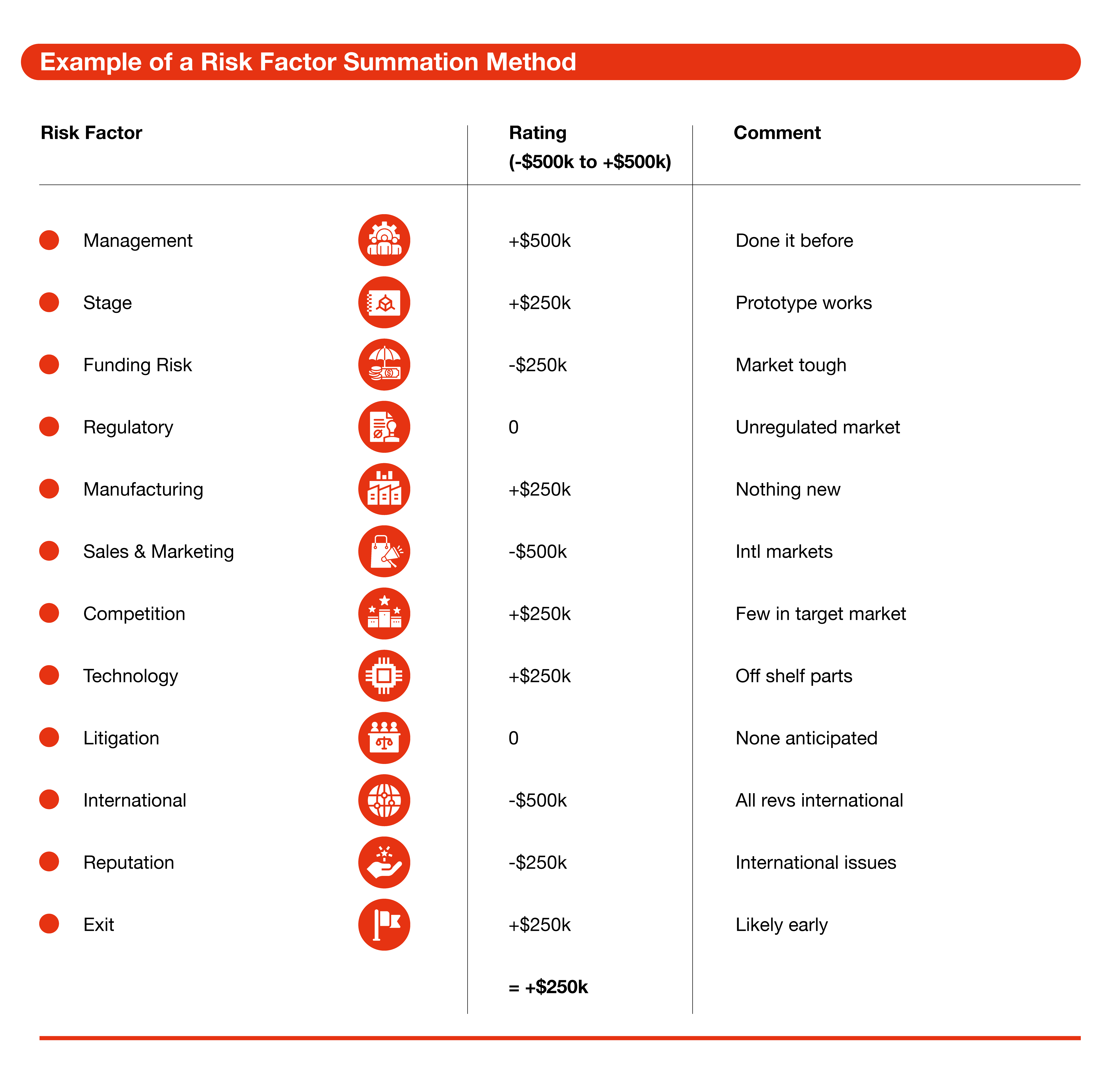

Risk Factor Summation Method

This method is very similar to the Berkus and Scorecard Method, as it combines both approaches and improves them. By taking a pre-money starting point similar to two other methods, you then consider the competitive advantages by assigning each quality of the company a value between + 500’000 and – 500’000. This is what it could look like:

You then add the amount calculated by this rating column to the pre-money starting point, which will then give you your pre-money valuation.

Cost to Build Method

With this method, investors try to calculate how much it would cost to replicate the same company from scratch. The aim is to determine the competitive advantage of a startup. To do so, thorough due diligence is needed. Factors such as investment costs, wages, and time needed, influence this consideration. The harder it is to replicate, the higher the valuation usually ends up being. Investors rely on the respective startup’s management team to tell them how much money, time, and effort it essentially cost them to build the company. If the founders didn’t track their invested hours, then it’s already difficult to calculate the valuation based on this method.

Keep in mind that this method only takes the past of a company into account but not the future potential. It also neglects factors unique to the startup, such as the team, which usually cannot be easily replaced.

Venture Capital Method

With this method, you calculate the value of your company on the basis of the amount of money expected to be made upon an exit. To determine that amount (also known as terminal value), you usually refer to the price-to-earnings ratio. When you have come up with that number, you divide it by a return factor, which represents the profit an investor wants to have made with their investment by the end of the investment period. Usually, that is a multiple of the amount they originally invested, which tends to be around 10, 20, or even 30 times the amount of their original investment. The factor depends on how risky the investment is. If your company is rather unlikely to earn high revenues, investors want to get more for their money in case your company does in fact succeed as they put their money in jeopardy.

If a company generates profits or is expected to generate profits, then usually the price-earnings ratio is used to calculate the terminate value. In case a company cannot generate substantial profit and focuses on revenue growth, then the price-revenue ratio can be used. According to valuation experts, in a price-revenue scenario, the bandwidth between 1 – 7 is usually applied.

Here´s an example:

The startup “JuiceIt” has developed a unique juicer that guarantees a juice yield of up to 99%. JuiceIt is now ready for a seed financing round but has not generated revenue yet. In order to get a final value, the value of the company, there is the option to calculate the future revenue. This final value is usually estimated using a multiplier (e.g. a price-revenue ratio, which is applied to the projected revenue of the company in the projected exit year).

The formula for this is annual revenue * Price-Revenue / (1+target revenue at the point of exit) ^ number of years till exit.

In our case of JuiceIt, these are the following figures:

- projected revenue at exit year CHF 3 million

- investment period (exit date) 4 years

- price to revenue ratio (PR) multiple 3 (a matter of discussion)

- target return of the investor 45% (typically between 30-70%)

The final value can now be calculated:

Post-Money Valuation of the company = 3’000’000 * 3 / (1+0.45) ^ 4 = 2’035’956.90 CHF

You can download the calculation sheet: HERE.

Comparables Method

When investors use this method, they compare your company to similar ones in your field and look at how high they were valued at a certain stage. They usually divide the valued amount by the number of customers to determine the value of each customer, so they can apply it to your company with your (future) amount of customers. Keep in mind that this method calls for a larger amount of data and key figures than for example the Venture Capital method or the Berkus method.

2. Series A

Discounted Cash Flow Method (DCF)

This method relies on assumptions as well as calculations that you have to make prior to using this method. You need to estimate your cash flow over a period of time in the future.

This method looks at how high the cash flow of a company is in a set period of time in the future, for example, the next five years, by taking into consideration that money loses value over time. Therefore, the value of cash flows needs to be discounted in order to calculate its current value. By adding up the single discounted cash flows per year you end up with the startup’s final valuation.

Multiples Method

To calculate the value of your startup, an investor could say he values your company 5, 10, or even 15 times the number of your current earnings (EBIT or EBITDA) or revenues. Which factors are being used, depend on the industry and the experience of similar companies.

This is a simple and quick way to evaluate more mature startups.

For B2B startups a factor of 7-12x of Annual Recurring Revenue may be used.

An example:

There is not one single method of how investors value startups. We learned that by talking to several investors and asking them about how they determine the value of a young company. Usually, they use more than one method in order to come up with an average value.

This process varies from investors and associations. Dorian Ebneter from BV4 told us about his approach:

“We focus on a qualitative Scorecard Method to evaluate Pre-Seed and Seed startups to capture the true potential of a company. With companies in the Seed phase we additionally apply the Comparables method, and then use the DFC and VC methods to conduct a weighted average with a strong emphasis on our proprietary scorecard model.

When looking at Series A and later-stage company valuations, we shift the weighing more towards models that require tractions such as the DCF and the VC method as well as the Comparables method to determine the fair value of the company.” – Dorian Ebneter, CEO BV4

Final comments

During the phases of Pre-Seed and Seed, there usually is no systematic valuation used by investors. Make sure the valuation you call has an underlying story based on a or multiple early-stage valuation methods. As a rule of thumb you should not give after a Series A it is ideal when founders still have more than 50% ownership of the company. This means in a Pre-Seed round you should only sell 20-30% of your stake and in a seed round 10-20%. The money you raise ideally lasts for 18-24 months. If you raise too little (for example due to dilution concerns), it could turn away investors, because they know that you’ll have to raise funding soon again and that could distract you from achieving your goals.

Fundraising is ultimately about:

- Plausibility (does your story incl. financials make sense)

- Market potential (can it be big)

- Reputation of your team (do investors believe that you can pull it off)