An overview of ESOP

In this article we will uncover the details that will support you in learning and acting on employee stock incentive programs to help you drive your business forward.

For many startups, it’s usual to create a so-called “Employee Stock Option Plan” (ESOP) to make sure that key or even all employees receive a benefit for their commitments. Why? Because it’s normal for startups to not pay as competitive salaries as larger companies do. By offering shares, startups can incentivise their employees with company shares to make up for this gap. If managed and communicated well, it can have a positive lock-in effect on your employees. It’s a natural path to generate loyalty, as you demonstrate that you are willing to share the anticipated success.

Nevertheless, if you decide to let your employees participate in the potential success of your company, then also make sure they get the best possible deal. It doesn’t only benefit them, it will benefit you as well if your employees know that you are giving them the best possible option plan.

Having said that, different stock option plans imply different efforts and costs related to set up and maintain. In Switzerland, it is common that 10% of the shares are given to employees. In the US, on the other hand, it goes more towards 20%. Each country has different rules and taxations and therefore different options are being offered to employees.

Fun fact: Charlie Ayers became a multi-millionaire by being Google’s first chef! Google offered a stock option plan.

To be fair though, these kinds of stories are extremely rare in Switzerland. Companies are giving fewer stock options to employees because salaries are genuinely higher and there are more securities here than in the American market.

Once you think about implementing a stock option program, we highly recommend consulting a professional lawyer who has extensive startup experience. Their background is important because some terms are special to startups and these lawyers have probably already seen what can go wrong in life.

Here is a list of professionals (we do not take responsibility for the quality of these lawyers).

In this article, we will explore various stock option choices as well as key elements to consider when offering various plans.

The Stock Options

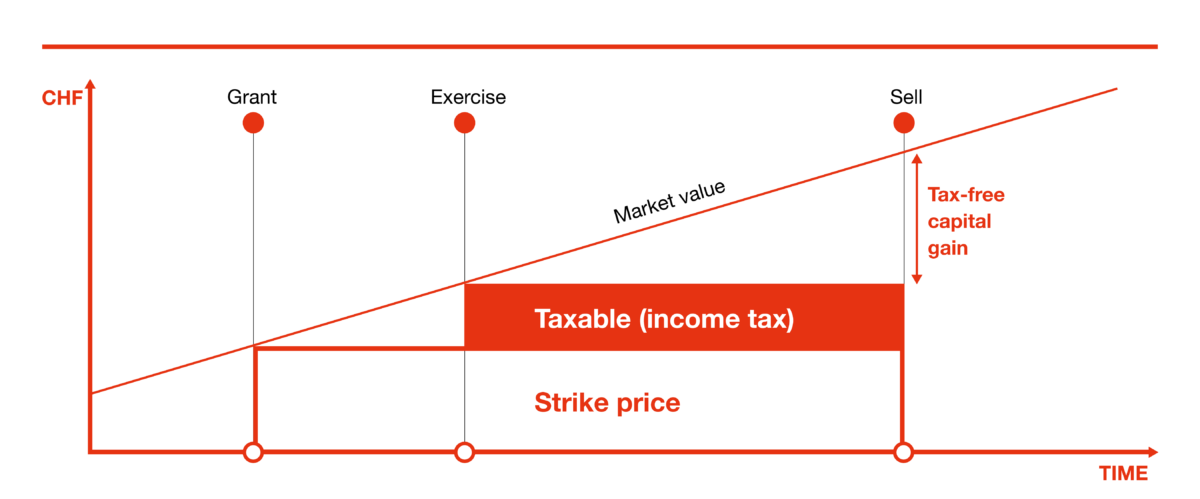

Employee stock options (ESO’s) are a form of equity compensation that companies give their employees and executives. This allows employees to buy shares of their company’s stock at a special price (also known as grant price), during a set period of time. Employees benefit from this option when the grant price is lower than the current market price. If that is the case and the employee decides to sell their share of stock, they can generate profit!

Most commonly, startups grant their employees this option as they want to reward early employees and involve them in the success of the company.

On the other hand, already well-established companies also make use of this form of equity compensation. Their goal lies in motivating employees to increase the value of the company’s stock with their work – which the company would, in return, profit from. It also motivates them to stay at the company for an extended period of time as employee stock options vanish as soon as an employee leaves the company.

Phantom Stocks

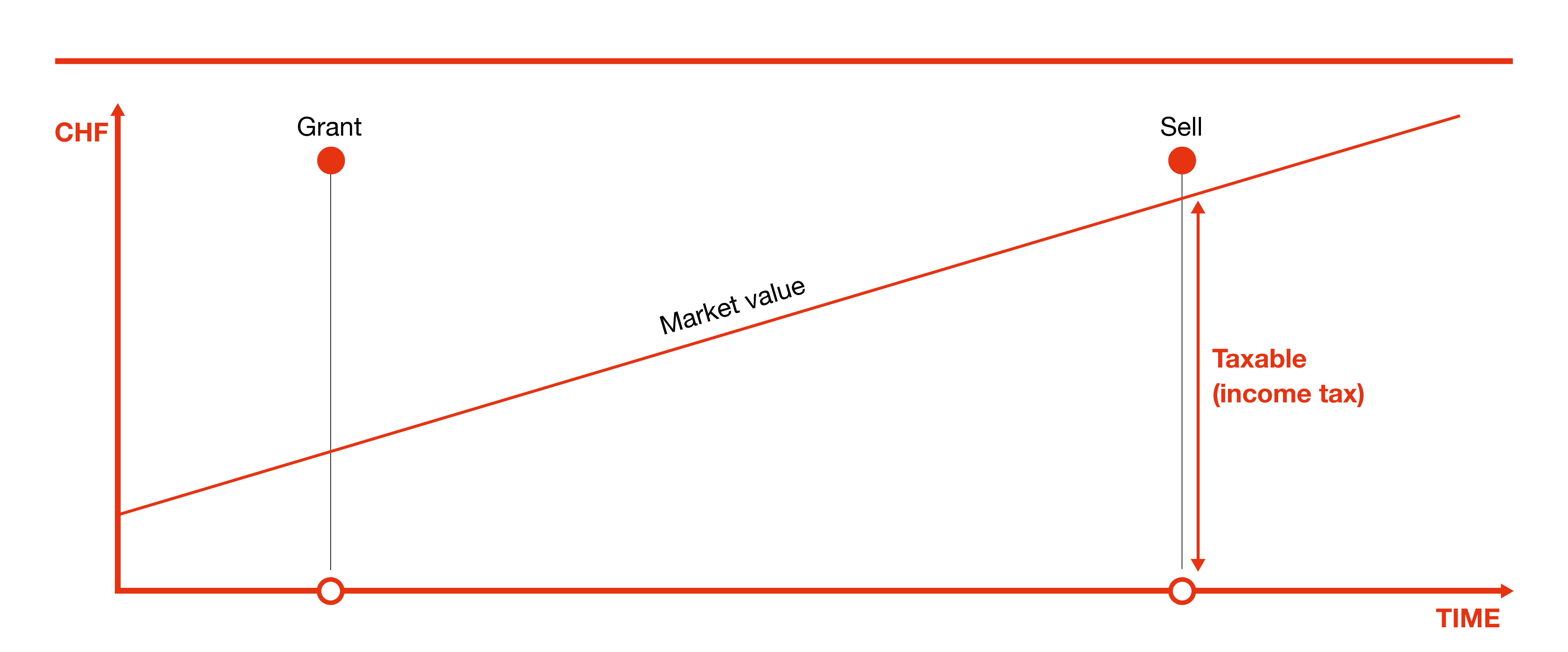

This kind of stock plan pays an employee a certain monetary share in potential liquidation or sale proceeds equal to the value of “X” number of shares. This means that the employee doesn´t actually possess real shares (hence the name “phantom stocks”), but they receive the amount of money related to the value of the company’s shares. In other words, it’s basically a participation scheme without shareholder rights.

By using phantom stocks, companies can reward employees without having to give them a part of the company.

Two considerations to phantom stocks:

- The money employees receive from phantom stocks gets taxed the same way regular income does

- Social security contributions from both the company and the individual employee have to be made

Common Shares

Common shares are shares of a company that represent a certain degree of ownership.

As opposed to preferred shares, common shareholders don´t benefit from special privileges. In the case of a company’s liquidation, they are paid out last as they have the lowest priority.

Taxation

If your company decides to let its employees participate in the potential success of the company, you need to ensure they get the best possible deal. This will benefit you as a founder as well if your employees know that you are giving them the best possible participation plan. However, different stock option plans could imply different efforts and costs related to the setup and administration of the plan.

Tax Ruling in Switzerland

Swiss tax laws are designed in a relatively flexible manner to ensure they are broadly applicable. This sometimes leads to companies not being 100% sure how the company and its employees will be taxed.

Luckily, there is an option called “tax ruling” available, which provides security in tax-related matters. When you go ahead with a tax ruling, you basically agree with the Cantonal Tax Authority on the valuation mechanism.

The result is a pre-agreed and approved tax formula, which allows you to precisely predict taxation (and social security contributions) for your organisation and employees.

Tax rulings are early fiscal decisions regarding your specific case, which are made on a cantonal level. These decisions are binding and provide you with legal security. A tax ruling basically determines how high your employee’s shares will be taxed in the future. Employee share incentives are usually subject to employment income tax and social security contributions.

For common shares, the following rule applies: If there is a difference between the market value and the amount the employee paid for the share (at exercise), it is viewed as income and is taxed accordingly.

This may pose a problem to certain employees as they have to pay taxes on shares, despite not having made any money off of them yet. Employees and the company will also have to pay social security contributions. If the employee decides to sell the shares later on, it is considered a tax-free capital gain (within the applicable tax formula).

Watch out! Cantons have different practices on how to treat founder shares, so make sure that you are well protected!

This means it is financially most attractive for employees to get shares granted (and exercised) as early as possible, even if they have to pay taxes at this stage.

Employee shares, phantom stock, stock appreciation rights and stock options are taxed differently. They are not taxed as soon as an employee receives these options, but when they decide to ‘exercise’ the shares’ value instead (meaning when they get a return from the shares). Income tax applies here. In comparison to genuine shares, there is no risk of potential capital loss as there is no need to pay taxes for shares that may not pay back the investment.

Knowing how your employee’s shares will be taxed allows you to assess your fiscal position before actually having to pay your taxes. This helps you with financial planning and ensures that tax authorities will not demand too much money from you.

AUTHOR

Julian Stylianou

CONTRIBUTERS

Ioana Voicu

Adele Bottoni